Reopening Does Not Mean Back to Normal

Key takeaways:

- Social distancing will continue even as businesses reopen

- Expect more volatility in bonds. Know your overall credit risk will be changing.

- It is hard to own oil directly.

- Putting back RMDs that were taken the first quarter of this year.

Social distancing will be around for a while

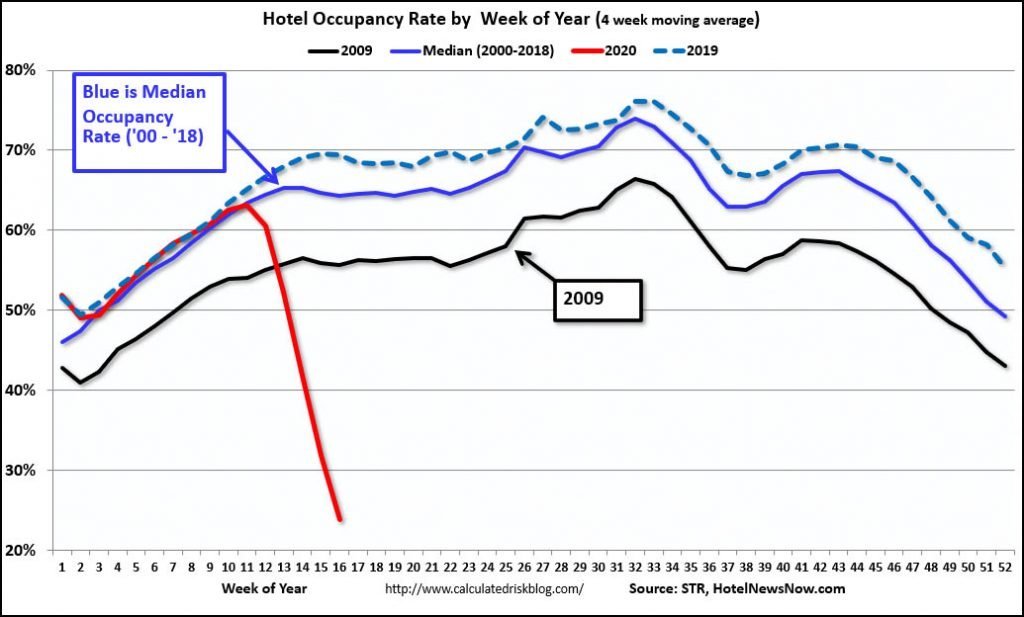

Some States are starting to reopen the doors for business. Yet, it is clear certain industries will continue to have a difficult time getting back to “normal”. For a further drill-down look at this hotel occupancy rate chart below:

Occupancy is down close to 70%. It’s so bad that Hilton recently sold 1 billion dollars’ worth of points to American Express for cash. So, if you have an American Express credit card you may be getting a lot more Hilton offers now.

Let’s be clear: social distancing has shown signs of working and flattening the curve. As some states reopen back up it will be interesting to see if social distancing measures are adhered to. And will business open back up? I know a few restaurants local to me and they have said that they can’t operate with half occupancy. One of which has decided instead to broaden their menu and focus on take out. Imagine getting pizza and sushi from the same restaurant. Probably will make deciding where to get food easier for families with varying opinions. Hotels will have to double their cleaning crew staff and poker tables in Vegas just got a lot wider if they want to safely reopen. If we don’t adhere to social distancing, as businesses reopen we could have both the seasonal flu and COVID19 cases to deal with that may result in another shutdown in fall. And heard immunity or a vaccine is what we need to get back to normal. But it may be good to realize business the old way may not be a good solution.

My investments are now junk…

There are so many problems under the surface we just can’t see yet. And when business start to recover after they reopen it won’t be as quick as many have taken on a lot of debt to survive. In fact, just prior to COVID19 a lot of business took on debt at low interest rate levels thinking interest rates would not be this low. This has been compounded by these same businesses taking on additional debt through the CARES Act. When business suffers, revenue suffers, and the pressure to support all that debt makes for more than a few sleepless nights. When credit rating agency do their mid-year reviews, the volume of downgrades and size of the high-yield junk bond market will likely double.

That’s bad news, but what’s worse is that many institutions will be forced to sell. Why? Certain foundations, pensions, and other investors—by policy mandate—can only hold investment grade-rated debt. Think of it like forced selling. Knowing this, do you think market makers will step up to make a market? Who might the brave buyers be? The smart money will step aside, let the system clear, and buy back in at distressed levels. Stay tuned. And watch a new wave of credit agencies downgrades to hit the news cycle in the summer months.

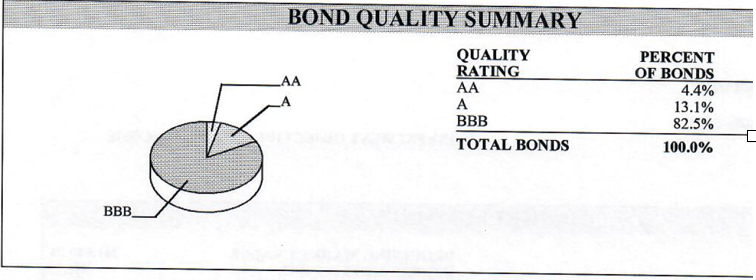

The above picture is from a client’s end of quarter statement in March from a managed account solution from my prior firm. BBB is on the boarder of being considered junk bonds. If you don’t watch what you own, you will find a lot more volatility than one would want in this environment. Like the person above.

When does oil become an investment opportunity?

Of all the craziness that happened last week. The biggest jaw breaker has to be the price of oil or the lack of. Futures contracts went negative meaning sellers were paying buyers to take their oil. The main reason behind this is as the global economy stops working to deal with COVID19 there is a ton of supply still in the system, but companies have run out of room to store it. And that makes it hard to want to hold a contract for oil. Maybe this is an opportunity to fill our oil reserves to the max.

But as some of us see oil hitting new lows, we often find our selves thinking should we buy the dip. A massive imbalance of supply and no demand cause spot price to collapsed. But how do we buy oil besides owning a future contract since all other options are indirectly owning oil. When you look at an oil ETF such as USO (US Oil ETF), they’re rolling over and buying oil futures. The ETF is down 60%+ year-to-date, and because they buy the oil future, if the oil hasn’t increased in price above the future price, then you lose money on it. So, it’s very challenging time. The oil and gas companies also have business risk associated with them and most have spent significant money diversifying their revenue.

I remember the BP oil spill and thinking oil has to come back and would be a good short-term investment. At that time, I was living in New York City on the upper westside and was barely making enough to save. I took all my savings I had set aside for an engagement ring and bought BP at $40 dollars a share in early May of 2010. I was wrong it didn’t come back like I thought it would even after the oil spill being contained. Luckily, I had other savings and still got engaged later that year. Here we are hoping $40-$50 dollars of barrel comes back and even with that a lot of companies that are simply not profitable.

Maybe it is my personal experience trying to invest in something that is obviously off balance, but I don’t know when and how we add oil in as a tactical investment holding. Just like I don’t know when we should add ventilators/medical devices as investment. These types of investments are too specific from a perspective as a top down investment firm. We simply can’t make an educated guess with convincing probabilities on our side.

Unwanted IRAs

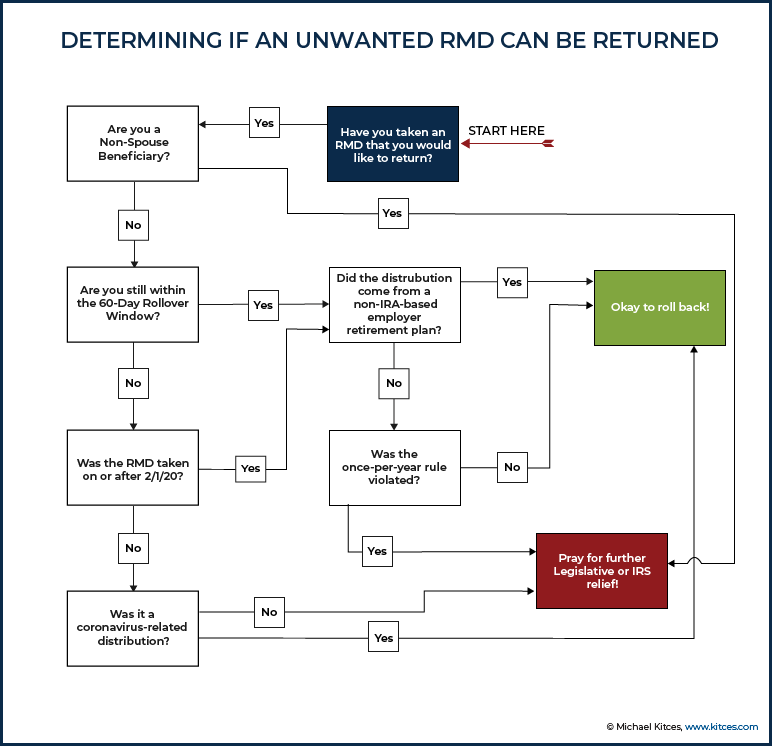

If you are in retirement and took RMDs between the beginning of the year till now and don’t need the money with the CARES Act there are a few ways to get those funds back into IRA accounts. This chart below should be helpful to understand the different options available to you.

If you are working with someone and they are not reviewing your bond holdings with you and credit risk associated, please reach out to us. Contact us and stay safe and keep distanced!