Debt a lot of debt

Key takeaways:

- In 2008, the Feds defining moment was buying AIG … in 2020 the Fed is buying junk bonds

- Demand across all categories is down and supply is up

- Fundamentally rebalancing is what increases returns and reduces risk in volatile times.

The Fed in 2020

When we talk about the Fed and debt, we are talking about the government buying assets, typically bonds, and in return putting cash into the system. No one knows how much the Fed will expand the balance sheet, currently we are at 7 trillion. In past recessions we have dropped rates 4-6% on average. At the start of COVID19 interest rates were at 1% leaving very little room to drop rates. In recent years the Fed has decided to turn to quantitative easing and create these special purchase vehicles (SPV) as ways to increase the money supply. Both of these actions increase the risk on the Feds balance sheet. Especially when the Fed has used SPV to buy junk bonds. I think this is fundamentally what is different this time.

In many ways, the Fed owning AIG in ’08 was a defining moment. This time, it is tax payer money funding junk bonds. This is a crisis so I know drastic measures need to happen but this strategy impacts how markets fundamentally function. For cycles to perform correctly over time you need well managed companies to survive and mismanaged companies to fail; it’s part of capitalism. Most of the time the good companies grow and take on the business of bad companies. But when the government is buying junk bonds, we are not letting companies fail. And by not letting companies fail we are taking revenues away from well managed companies. Do you see how this could have a domino effect? This will lead to zombie companies, currently there are estimates that in the future 20% of companies are operating to pay their debts. This will reduce long-term growth of good companies.

Well I’m guessing you are wondering by now who is paying for this debt. And the answer is not as easy as one may think. Just like with the national debt we typically say it’s future generations, here it’s not that direct. Most of the time we will never pay it off and for some reason history says that’s okay. Since it is not like a mortgage where there is a definitive end date. Here the debt can keep rolling and the net effect is the economy grows its way out of the burden of debt the Fed has taken.

Demand is dropping across the board

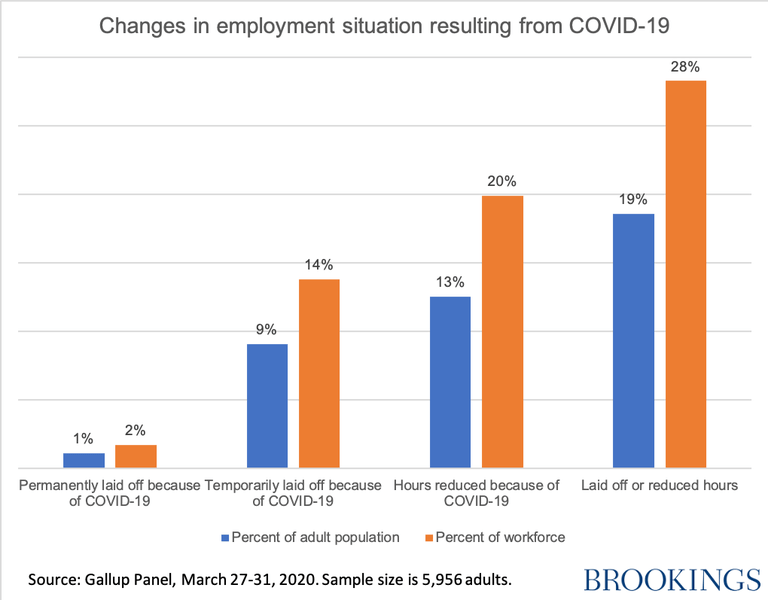

I wonder what the graph above would look like when we add the latest jobs numbers. Just think about it, 1 out of 6 would be working Americans are out of a job. The initial claims went up by 3.84 million in the last week which put 30 million people out of work effectively erasing 23 years of job growth in 6 weeks. Although furloughed employees can claim unemployment no all do. Although not as bad there still is an impact from furloughing an engineer verse retail sales employee. Most of the time high wage earners that are furloughed reduce their discretionary spending and that impacts how we see consumer confidence changing. The longer this down shift continues the less likely we see any V shape recovery.

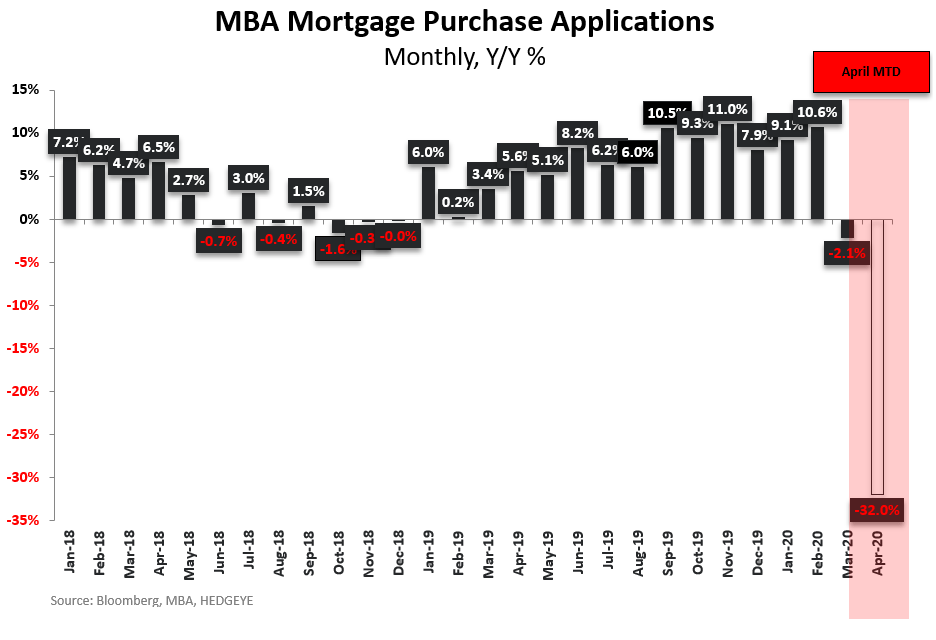

With less money on hand for consumers a negative shift in demand is accelerating. Looking at year over year mortgage purchase applications we can see a large drop off. A lot of people have put home purchases on hold. And for good reason, there is a lot of uncertainty for people to make a high capital expense. The economy is made up of supply and demand. We need a balance of both. When we have a lot of supply and no demand that spells trouble because it stops spending. There is an inherit expectation that the cost of something will be cheaper in 6 months. When consumers wait, and prices do drop, since there is a large supply and no demand prices thus validating our thought process. The slow down in demand will continue. Eventually there is a level we hit and demand starts picking up.

Rebalancing

People who buy and hold simply don’t have a process. Or have a process that over time many take on more risk than they realize or have very low risk adjusted returns (underperformance). Having a process is key in this type of environment, it is fundamentally how you earn a return in volatility. A typically, long-term portfolio will rebalance 1-2 times a year within their tolerance bands. This year we have already rebalanced 3 times and we are not even in June. We are rules based and the rules determine how we rebalance. We strive to take emotions out of our investments. The process of rebalancing predominately moves money from bonds into equities and vice versa. One of the reasons for multiple rebalances have been our tactical positions of large quality companies, technology and treasuries; all of which have help significantly protect downside risk. So even as your accounts may have not changed much these rebalances are based off of market indices and that has allowed us to purchase more of the broader indexes while they are down. The reason I am explaining this is because we still believe there will be worse economic news coming out over the second quarter. Remember we have 3 problems: liquidity, credit and covid19. And we are still in act 1 of 3 (See Covid-19 and Market Commentary). The economic gravity is still very negative. Which means we see more volatility in Q2 and more rebalancing ahead.

As we continue the weekend read, if you have questions or topics you want my thoughts on please e-mail me at info@clientfirstcap.com. If you are thinking about something, I know other clients are as well. If you have an advisor that is rebalancing quarterly or if you are not actively controlling the amount of risk in your portfolio, we would be happy to provide you a risk analysis.