2025 Investment Outlook

Key Takeaways:

Growth will slow unless labor productivity can increase.

Inflation is making a comeback.

A higher debt burden limits the Federal Reserve’s options.

Maximizing Your Year-End Tax Strategies

As the year winds down, tax season begins to come into focus, making it a critical time to review and adjust your finances for tax-saving opportunities before year-end. While not all financial advisors provide extensive tax planning services, this area of expertise is a hallmark of Client First Capital. Advisors can offer strategic guidance to ensure your year-end planning goes beyond routine tasks, helping you maximize tax efficiencies, protect wealth, and proactively position your finances for the future.

Online Safety for Seniors: Tips for Staying Secure in the Digital World

With the rise of digital tools and social media, seniors are increasingly online, enjoying the benefits of staying connected to family and friends, accessing information, and even shopping and banking from home. However, this increased access also brings certain risks. Online scams, phishing attacks, and identity theft are common, and seniors are often targeted due to their trustworthiness and less familiarity with digital threats.

How Retirees Can Invest with Downside Protection

Retirement presents a unique set of financial challenges for portfolio construction. Many retirees look for ways to generate returns while minimizing risk, especially after spending decades accumulating wealth. At Client First Capital our goal is to protect, preserve and compound. Our portfolio construction is built with two independent portfolios and, depending on our client’s needs, we tailor the mix between these two solutions based on meeting their retirement planning goal and ability to take on risk.

Managing Health Care Cost in Retirement

As people approach retirement, managing healthcare costs becomes increasingly crucial for ensuring financial security and maintaining a high quality of life. With longer life expectancies and rising medical expenses, retirees face the challenge of balancing their savings with the potential need for extensive healthcare services. Proper planning and informed decision-making can help mitigate the financial strain of medical costs, allowing retirees to focus on enjoying their golden years.

Retirement Planning, One Size Does Not Fit All

The recent survey by Northwest Mutual revealing that U.S. adults believe they need $1.46 million to retire comfortably has indeed ignited discussions on the appropriate amount necessary for a secure retirement. This figure aligns with the common notion that a nest egg around $1 million is often cited as a benchmark. Others disagree and point to a survey where 86% of retirees with savings between $50,000 and $99,000 report they are living a comfortable retirement or doing OK.

Protecting Your Retirement: The New Fiduciary Rule

In the complex world of finance, fiduciary responsibility shines as a symbol of trust and integrity. Recent developments have ushered in a new era with the introduction of the Fiduciary Rule. This article explores the fundamental principles of this regulatory shift, its implications, and key differences from existing standards.

4th Quarter Investment Planning Outlook

Before diving into the 4th quarter outlook, let's emphasize the importance of building a robust investment portfolio that guards against various risks. Our strategy actively addresses risks such as equity, interest rates, currency fluctuations, liquidity, credit, inflation, foreign investments, time horizons, and economic downturns.

Mastering High Net Worth Financial Planning: The Unique Challenges of Wealth

In today's ever-evolving financial landscape, the importance of financial planning cannot be overstated. It serves as a cornerstone for safeguarding one's financial well-being against life's uncertainties. However, for individuals and families with substantial wealth and complex financial needs, standard financial planning often falls short. This is where High Net Worth Financial Planning steps in to offer tailored solutions.

Mid-year Investment Outlook: Navigating 2023 and Beyond

As we step into the latter half of 2023, it's crucial to grasp the evolving dynamics between the economy and the market. In this mid-year investment outlook, we delve into the key occurrences of the past six months and shed light on the potential paths that lie ahead for your investments.

Navigating The Debt Ceiling Crisis

Global monetary policy hinges on the value of a risk-free asset plus a premium, and for years, US Treasuries have played this role effectively. Treasured for their liquidity and safety, they have served as collateral in countless global trade transactions.

Navigating Q2 2023: Investment Planning in a Shifting Economic Landscape

Key takeaways:

1. Reiterating: Profit-based recession is likely with major credit events

2. Reiterating: Risk of recession > risk of inflation

3. Reiterating: Fed pivot unlikely

It’s been an eventful start to this year. We have already had the 2nd and 3rd largest bank collapses of all time. The CPI calculation has changed for the first time in years. Mortgage rates hit 7.1% for the first time since 1993, and we are only three months into 2023. It’s only April and 2023 is already a year that will be remembered.

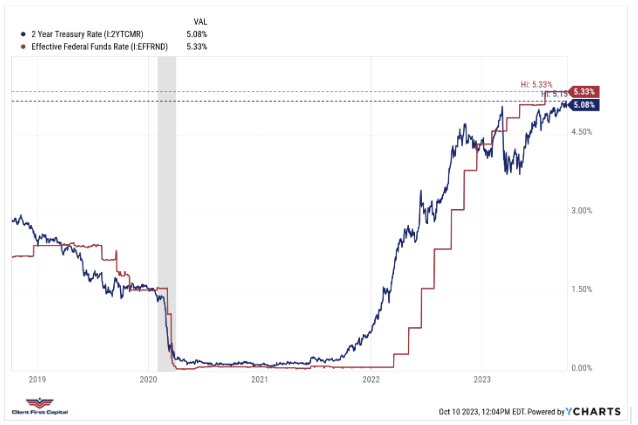

Top 3 Retirement Planning Lessons from Silicon Valley Bank

Well, it’s hard to hide from the news of the Fed and Treasury coming to the rescue of depositors of a failing bank. Silicon Valley Bank is the 20th largest bank in the United States of America and mainly serves the needs of startups and venture capital firms. And because of mismanaged risk and the inability to create liquidity when needed, the bank was taken over by regulators from the FDIC last Friday. This article covers the events that led to the failure of the bank and broader impacts as well as lessons learned from these series of events that can be applied to managing retirement.

The 2023 Investment Outlook and Investment Planning

Happy New Year! As we embark on our journey into 2023, we would like to share a comprehensive investment outlook that revolves around effective investment planning. The year 2023 brings with it a changing economic landscape, where legislative changes and global events influence the current market conditions.

Tax Planning for a Smart Retirement - The Top 5 Accounts

In the world of retirement planning, it's not just about saving for your golden years; it's about saving intelligently. The key to ensuring a tax-efficient retirement lies in understanding the various types of accounts at your disposal.

Potential for a Prolonged Recession and Implications for Investment Planning

In this ever-changing economic landscape, the need for sound investment planning is more crucial than ever. This article delves into the potential for a prolonged recession and its implications for your investment strategy. We will explore key economic indicators and strategies to safeguard your financial future.

Avoiding Poor Financial Decisions in Retirement – 5 Trends Retirees Should Avoid

This article covers some patterns and behaviors that may result in poor financial decisions and reduce the overall probability of achieving goals during retirement, such as enjoyment, flexibility, and control.

Market Commentary; The Persistence of Volatility

In this month’s newsletter, I hope to address key parts of our investment strategy, as well as highlight some definite wins and some areas that are still challenging. Seeing losses for the first time in the last 6 years can be challenging. Rest assured that our risk management process is helping to limit those losses.

Staying Focused During Times of Conflict

When something “big” happens in the global universe, our natural tendency is to ask, “What happens next?” The markets ask the same question and they usually have an adverse initial reaction because the markets don’t like uncertainty. However, the ultimate effect on the marketplace may not be what you might think.

Risk of Recession

It’s normal to be concerned about your investments given the current situation of the world right now. Over the past few weeks, I have received a few questions around risk that I believe merit further exploration.