Market Commentary; The Persistence of Volatility

Key Takeaways:

We have all witnessed the market volatility this year driven by three converging trends which we believe will peak in late Q2 – economic slowdown, fiscal tightening, and monetary tightening.

Bonds will continue to be challenging from a return standpoint until the Fed reduces the aggressiveness of rate hikes

In periods of high volatility, it is important to stick with a disciplined investment strategy and risk management

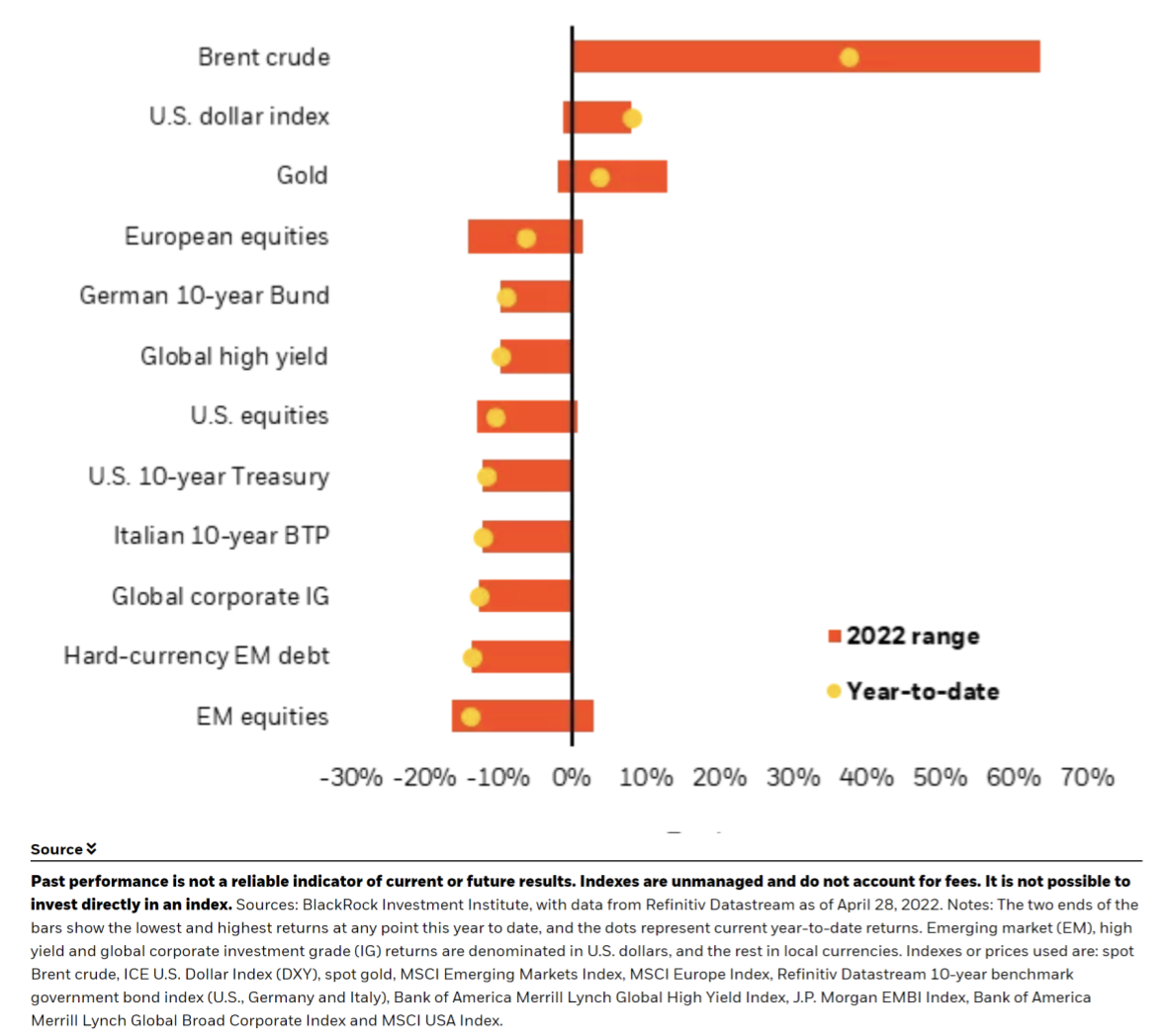

To offer some context before diving into the market commentary, the chart below shows year-to-date returns and the range of returns for different core asset classes. As you can see, very few asset classes have performed positively. A majority have had double-digit losses.

While volatility is generally uncomfortable for investors, back-to-back daily swings of 3%+ are downright nerve-racking. It weighs on all our emotions, and I understand clients’ fears. Almost all investors share these feelings, but a sound investment strategy can make these volatile periods less emotional. More importantly, a sound investment strategy helps avoid making poor investment decisions. In this month’s newsletter, I hope to address key parts of our investment strategy, as well as highlight some definite wins and some areas that are still challenging. Seeing losses for the first time in the last 6 years can be challenging, but rest assured that our risk management process is helping to limit those losses.

A week in Review

The S&P 500 dropped to new lows last week, to have its worst month since the pandemic’s sell-off in March 2020. The U.S. economy unexpectedly contracted in the first quarter, and consumer and business spending are starting to show some weakness.

With the S &P’s losses, there was literally no safe space to hide except US cash for the last week. Bonds faced huge selloff as a raising interest rates put more focus on default rates on junk bonds. US Treasuries also faced a sell-off as the 10-year Treasury note hit a high of 3.123% on a strong jobs report.

The Fed raised rates 0.5% last week, thereby increasing the Fed funds rate to 1.0% at the time of writing, while the Bank of England is poised to hike rates another 0.25%. Fed Chair, Jerome Powell, may reiterate his tough talk on reining in inflation, but he realizes the speed at which rate hikes happen will have a greater impact on the economy. With another higher inflation print today, and almost no unemployment, the Fed will be forced to continue to debate raising rates at 50bps rate increments. We think the Fed will continue to lift policy rates through 2022, but ultimately will have to re-assess.

Some challenges specifically with bonds

The graph below shows bond performance during challenging times:

By definition, being diversified means owning many different types of investments to manage a range of risks regarding potential outcomes. Historically low rates have made us question the role of bonds in portfolios especially as we go into a raising rate cycle. That said, we can’t forget the protection that bonds have provided in previous corrections. Bonds over a larger time duration were positive during all the 15 recessions since 1929, averaging 7.8%. However, bonds have experienced their third-worst 2-year period since 1926. It has been difficult to manage risk for clients within bonds since the yield curve is essentially flat, and with little to no yield. Our view has been to buy treasuries in proportion to the whole yield curve, specifically to our view that speed of rate hikes will cause the economy to slow down and increase credit risk within bonds.

When we made our changes within bond holdings in January, we were looking at 5 rate hikes. Today, Wall Street analysts expect 10- 11 rate hikes (including the 2 we just had). Our view is that the US economy cannot handle more than a 3% Fed funds rate. And such an aggressive rate increase cycle will cause too much damage to the US economy: Earnings (down), Credit (down), Growth (down), Unemployment(up), etc. Once the market realizes this, or the Fed backs off, then we can expect bonds to bounce back. The US Agg bond index is down close to 9.8% as of Friday. We still believe in our tactical bond holdings as they diversify one’s portfolio. There are still many scenarios that can happen that will cause bonds to perform well. Especially in a black swan type of event: think about concerns specifically with China and Taiwan. We do not know what the future holds, but there is a real chance that bonds may end up being the best performing asset class over a larger time domain as in the charts above.

Preparation for Second Quarter (reminder of changes)

Our risk management process is based on the rate of change between GDP and Inflation. In our quadrant framework, we are in the bottom left quadrant which is characterized by disinflation with the rate of change of inflation decreasing. In late December / early January, we shifted our investments into holdings that do well during a disinflationary environment. Since 1948, there have been 14 periods in time where we have faced disinflation. Based on backtesting these periods, we reduced our stock holdings by 20% on average and rotated out of commodities, junk bonds, technology, energy, and small caps. We rotated into consumer staples, utilities, treasuries, gold, and US dollars as they tend to do a better job risk managing the downside in a disinflationary environment. This rotation has helped benefit our clients from large drawdowns year to date.

Additionally, I want to make it clear that this is an ever-changing landscape. Our view is that fiscal tightening and monetary tightening going into an economic slowdown will create a very challenging environment for investments across the board for a couple of quarters or more. There is fiscal tightening because Congress is not spending money on extra programs such as PPP loans, airline bailouts or stimulus checks (approx. $1.3T is rolled off the books in the month of March/April). There is monetary tightening via interest rate hikes, and the rate of increase in interest rates is at a pace that is aggressive enough to significantly hurt the economy. To give some context, the last rate increase cycle took 4 years. As bonds mature, they are being rolled off the books which is adding to the tightening of the money supply. Unfortunately, the Fed’s policy risk has intensified by not only not acting when they should have but also to the point of probably breaking something. But because this is a changing landscape, when the rate of change in growth changes to being positive, we will be adding back to our equity positions.

With a few rocky upcoming quarters, we want to reiterate the importance of sticking with a well-defined investment process and risk management strategy throughout volatile periods. Within our portfolio management, we have carved out a liquidity component, and regardless of the market’s volatility, there is always a safe place to access funds. If you have questions, we are always here to walk through our strategy in greater detail and be a sounding board to help make better financial decisions please fill out our contact form and we will get in touch with you.