Mid-year Investment Outlook: Navigating 2023 and Beyond

Unlocking Opportunities in a Shifting Landscape of Investments

As we step into the latter half of 2023, it's crucial to grasp the evolving dynamics between the economy and the market. In this mid-year investment outlook, we delve into the key occurrences of the past six months and shed light on the potential paths that lie ahead for your investments.

1. Heightened Tail Risks Amidst Liquidity Changes

The tightening of liquidity has emerged as a notable factor, augmenting tail risks within the investment landscape. This environment calls for a comprehensive assessment of your investment strategies to effectively navigate potential challenges. Click to learn more about tail risk.

2. Recession Risk Takes Precedence over Inflation

Clarifying our stance on the prevailing economic conditions, we emphasize that the risk of a recession outweighs concerns about inflation. This perspective underscores the importance of strategic asset allocation to mitigate the impact of economic fluctuations.

3. Federal Reserve's Stance: Unlikely Pivot

Reaffirming our position, we reiterate that a significant pivot in the Federal Reserve's approach is improbable. This insight has profound implications for investment decisions, urging a proactive approach to safeguard your portfolio against uncertainties.

Economic Landscape: Unveiling Insights for Informed Investments

Analyzing Key Events of the Past Six Months

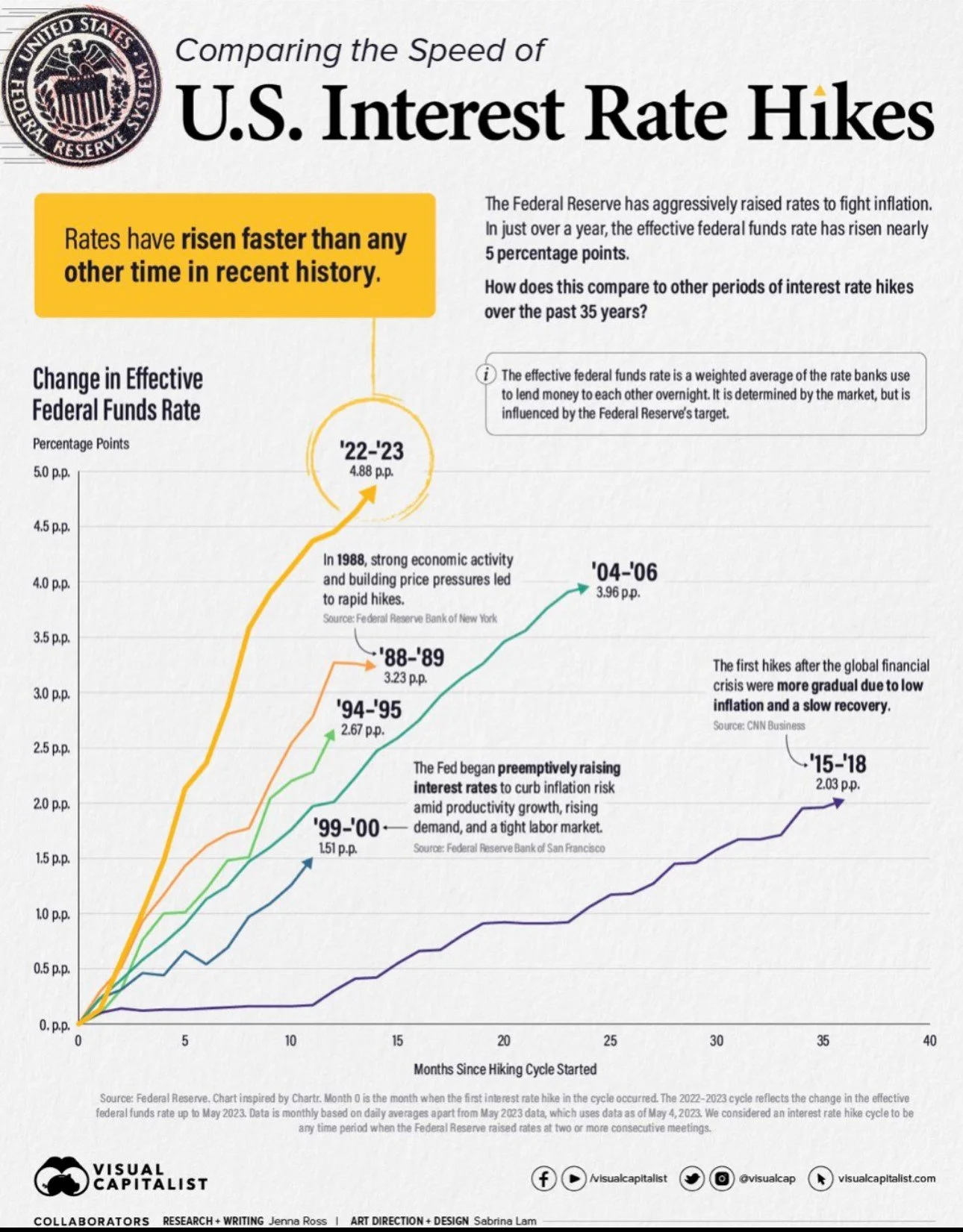

Unprecedented Interest Rate Hikes: A notable highlight is the unprecedented increase in interest rates, underscoring the need to gauge their potential influence on your investments.

Surging Mortgage Rates: With mortgage rates surpassing 7.25%, even exceeding levels seen during the 2008 crisis, a careful evaluation of your real estate investments becomes imperative.

Financial Institution Collapse: The collapse of three major banks, collectively holding assets greater than all collapses during the 2008 financial crisis, emphasizes the significance of assessing risks linked to commercial property investments.

Debt Ceiling Quandary: The unresolved debt ceiling crisis, postponed until after the upcoming elections, calls for a vigilant approach as you strategize for the future. Click here for more information on the effects of the Debt Ceiling Crisis.

Shift towards Non-US Dollar Transactions: The increasing prevalence of transactions between countries in non-USD terms introduces new dimensions to consider in your investment decisions.

Navigating Market Directions: Up, Sideways, or Down

Upside Potential: Capitalizing on Momentum

Amidst the potential market scenarios, a compelling argument for an upward trajectory rests on a soft landing coupled with the infusion of sidelined capital into stocks. This perspective underscores the value of aligning your investments with this potential upward momentum.

Lateral Movements: Balancing Gains and Costs

Market consolidation, involving the integration of smaller entities into larger corporations, offers potential cost efficiencies. However, the challenging landscape of corporate lending rates, ranging from 13% to 17%, poses profitability concerns. As you make strategic decisions, it's crucial to consider both positive and negative implications.

Potential Downturn: A Deeper Exploration

Delving into the prospect of a market downturn, it's essential to acknowledge that markets can remain irrational longer than investor rationality can endure. This realization underscores the significance of a well-structured risk management and strategy.

Strategic Investment Approach: A Framework for Success

Analyzing the Current Environment: A Four-Quadrant Perspective

Our investment framework rests on analyzing the incremental rate of change in GDP and inflation through a four-quadrant approach. With a 62% probability of decreasing growth and inflation towards the year's end, the importance of recalibrating your investment strategies becomes evident.

Nurturing Growth through Risk Management

Our risk management process hinges on the interplay between growth, inflation, and policy dynamics. By meticulously tracking these variables, we can position assets to maximize risk-adjusted returns.

Growth Insight: Unveiling Underlying Trends

As central banks globally hike interest rates to curb inflation, various economic indicators reveal potential cracks beneath the surface. Understanding the intricate relationship between business slowdowns and labor market shifts is pivotal for informed investment decisions.

Inflation Analysis: Unmasking Trends and Predictions

Inflation's trajectory unveils its complexities, with comparisons indicating deceleration. However, the probability of re-acceleration looms, especially considering tight labor markets. In navigating this terrain, you must weigh larger credit events against the risk of heightened inflation.

Policy Dynamics: Federal Reserve's Conundrum

The Federal Reserve's current stance, featuring a funds rate of 5.25%, brings attention to the delicate balance between rates and inflation. As the Fed grapples with the impacts of its decisions, understanding their potential implications on the economy is essential.

Embracing the Future: Your Path to Informed Investments

Emphasizing Gold's Role: Within our model, gold remains a core holding among the asset classes, reflecting its potential value amid evolving policy reactions.

Personalized Portfolio Adjustment: We invite you to explore how our tailored portfolios can align with your goals. By assessing your current investments, we can offer insights into potential risks and economic impacts.

Seize the Opportunity: If you're ready to optimize your investment journey, take the first step by learning more about our tailored investment strategies.