4th Quarter Investment Planning Outlook

Before diving into the 4th quarter outlook, let's emphasize the importance of building a robust investment portfolio that guards against various risks. Our strategy actively addresses risks such as equity, interest rates, currency fluctuations, liquidity, credit, inflation, foreign investments, time horizons, and economic downturns.

Mid-year Investment Outlook: Navigating 2023 and Beyond

As we step into the latter half of 2023, it's crucial to grasp the evolving dynamics between the economy and the market. In this mid-year investment outlook, we delve into the key occurrences of the past six months and shed light on the potential paths that lie ahead for your investments.

Navigating Q2 2023: Investment Planning in a Shifting Economic Landscape

Key takeaways:

1. Reiterating: Profit-based recession is likely with major credit events

2. Reiterating: Risk of recession > risk of inflation

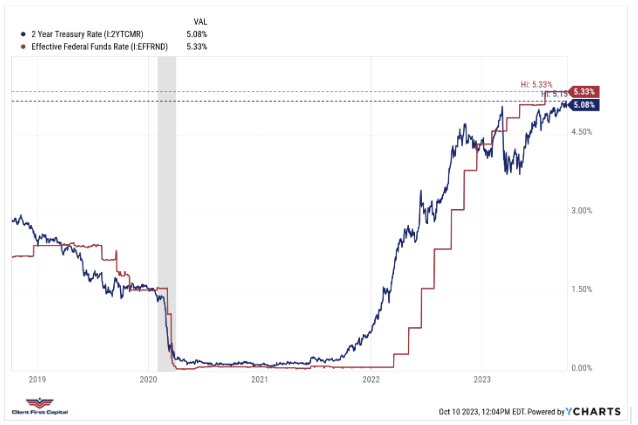

3. Reiterating: Fed pivot unlikely

It’s been an eventful start to this year. We have already had the 2nd and 3rd largest bank collapses of all time. The CPI calculation has changed for the first time in years. Mortgage rates hit 7.1% for the first time since 1993, and we are only three months into 2023. It’s only April and 2023 is already a year that will be remembered.

Top 3 Retirement Planning Lessons from Silicon Valley Bank

Well, it’s hard to hide from the news of the Fed and Treasury coming to the rescue of depositors of a failing bank. Silicon Valley Bank is the 20th largest bank in the United States of America and mainly serves the needs of startups and venture capital firms. And because of mismanaged risk and the inability to create liquidity when needed, the bank was taken over by regulators from the FDIC last Friday. This article covers the events that led to the failure of the bank and broader impacts as well as lessons learned from these series of events that can be applied to managing retirement.