Economic Gravity

Key takeaways from this week’s newsletter are:

- Fortune 100 companies are actively looking to reduce their real estate footprint.

- Economic Gravity - a disconnect from market to main street. April has proven to defy gravity.

- The Family Bank. IRS rules to be aware of when helping family.

Bioluminescence

The bright blue light, created by phytoplankton through a process called bioluminescence, has been spotted from the shoreline for the last few weeks in San Diego. Bioluminescence has transformed San Diego’s waters into an electric-blue light show. I remember as a kid going with my family to a local beach with my parents and watching surfers cutting through the waves creating these blue light spectacles in the dark. It was something special. Hopefully in a couple of years we will look back on this time as we remember individuals and kinds acts as something special as well. This week we are talking about a paradigm shift in office space, economic gravity and helping family. Enjoy!

New work environment

From a recent survey 50% of Americans enjoy working from home and do not want to go back into an office in the future. And 70% of Americans want the work life flexibility to work from home. Albeit its been less than 3 months but we now have corporations that would rather have some of their workforce work from home. But how will these companies measure productivity and have proper security measure in place? It seems early into this conversation of a transition to work for home staff, but maybe it's not. “JPMorgan’s traders were able to handle as much as three times the normal trading volume in the first quarter, even as 90% of the corporate and investment bank’s staff worked from home.” I believe this will cause the big bank to reconsider how they will operate their teams in the future. JPM employs nearly 250,000 individuals worldwide and changes will directly impact their office space needs. Recently Nationwide insurance company has decided to move 5,000+ employees to work from home permanently. The goal is to work in centralized hubs and remove remote offices. Once this goes into the effect Nationwide will be the first Fortune 100 company to have 30%+ workforce who work directly from their houses.

Demand for office building real-estate is down 40%. Although in low interest rate environments REITS and real estates funds tend to outperform. Especially for those looking for income, real estate has traditionally provided a stable flow of income. However, we have stayed defensive and have stayed away. For most business in offices their real-estate foot print is one of their top 5 costs. As companies look to stay afloat most of these debts / rent terms will have to be renegotiated. We feel there is simply too much uncertainty to how those terms will change to create a sleeve portion in a portfolio right now.

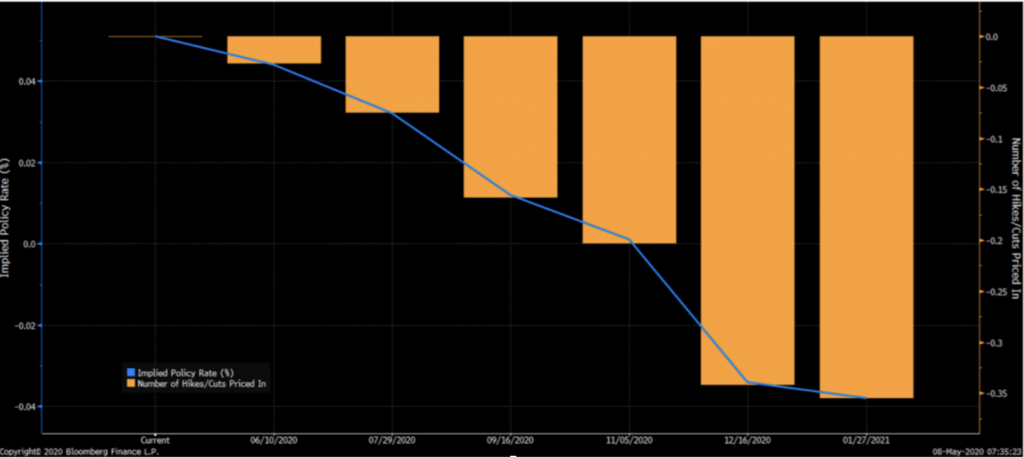

In the picture above you will see that the implied policy rate based off of analyst estimates show that on the long end there is a chance of negative rates on the horizon. Not in 2020 but further out into 2021. To protect portfolios against this possibility there is a tactical sleeve that has long treasuries and mortgage back securities that we continue to evaluate. The treasuries carry little risk as they are government backed bonds. The mortgages are also backed by government agencies but do have refinance risk and default risk. At present, we are comfortable with that risk as interest rates on the long end of the curve still have room to go down (bond prices go up) and most mortgages terms are still on 30-year notes. In addition, unlike 2008 most residential real estate still has significant equity and low default rates due to more thorough underwriting by the banks from lessons learned in 2008 as well as proactive steps taken by banks around forbearance.

Economic gravity

It's hard to stay on the course of a disciplined plan when we see the markets rally like in the month of April. But not much has changed from an economic perspective. In fact, one can argue the economic hole has only gotten deeper. And the deeper the economic hole the greater the lag in the system to bounce back. As humans there are multiple ways the media and social distancing may influence our perspective on the markets. And it is true the market have recovered a lot of the losses since February. But we have to take our emotions out of our investment decisions. If you look at the transactions you will see how the rules-based models adjusted to take advantage of the market upswing via (3 rebalances in 6 weeks). Looking at the rate of change in economic data the odds of further deterioration in economic data still remain high. For example, the jobs report, largest monthly drop in unemployment dates back to September of 1945 of 2 million; April’s jobs losses were 20.5 Million. And there is still another 3-5 million of unemployed not counted in the system. This rate of change in unemployment has never been seen in history.

It just goes to show the market and economic data are not the same thing. Although we are still defensive because of the economic data, we have taken steps to prepare you for the uncertainty by positioning portfolios for all different outcomes within your risk tolerance. Keep in mind a vaccine or a treatment plan that is proven effective would relax a lot of nerves and could quickly swing the market back to new highs. Low probability but there still is a chance. Our tactical decisions are based off the rate of change within the economic data.

Bank of the Family

As millions of people are found without a job or furloughed. You may have family members directly effected. They may even be asking for a loan or you may have thought about helping family members out in this time of need. There are strict rules around money flowing between family members. But here are some points to consider. First you can still gift $15k per person. In essence a couple could give each one of their children a total of $30k a year without any IRS reporting. Beyond that you will need IRS paperwork and it will eat into your exemption amounts. Another way is a loan from parents to child or any other family member. The minimum interest rates on these loans set by the IRS and in the month of May we have hit an all time low. Loans are defined in three categories, short less than 3 years, midterm 3-9 years and long-term for anything greater than 9 years. The interest rates are 0.25%, 0.58% and 1.15%. This could make for a huge cost savings for family members. Remember most credit cards are still charging 20+%. Just remember if you are going down the route of a family loan everything should be fully documented and should be reviewed by a tax professional to make sure it will protect you in case of an audit. If you are looking to help family members, let’s first look at the options together to determine which route you should take.

As we continue the weekend read, if you have questions or topics you want my thoughts on please e-mail me at info@clientfirstcap.com. If you are thinking about something, I know other clients are as well. If you have an advisor that is rebalancing quarterly or if you are not actively controlling the amount of risk in your portfolio, we would be happy to provide you a risk analysis.