Change is in the Air

Key Takeaways:

- A lot of positive signs.

- Strength of the USD

- We are still defensive in our portfolios.

- Confusion between Federal, State and local health mandates.

- Plan for income taxes to increase eventually.

Let’s get ready for sports! NASCAR, English Premier, and Major League Baseball all had big announcements this week getting a season calendar on the Map. Even Mike Tyson announced that he will be making a comeback in boxing. Its good to see the message boards of fans and athletes getting fired up again; I can’t wait. Another big announcement two new 5-minute COVID19 antibody test got approved this week and Lab Corp has placed an initial order for 2 million tests. Freeway traffic picked up by 15% this week and business are in a pinch to get employees back to work as part of the Paycheck Protection Program. Airport traffic had its first week of over 200,000 people traveling since March. Even cruise ships had record bookings this week. The seasons is changing and so is consumer behavior. When we got take out this Friday we had to wait around an to get our food. I am pretty sure the restlessness of being trapped at home and warm weather have sent people to relax their guard and get out of the house. This week we are going to talk about balancing the strength of the US, the need to stay cautions and taxes.

Strength of the USD

We talk about the drastic steps the US has taken to flatten the curve for Covid19 and how it has impacted the economy. Here is something I would like people to keep in mind. The Treasury sold a record amount of debt this week: $32 Billion dollars of 10-year notes at 0.7% and it was oversubscribed. Meaning there were more buyers than the amount of bonds being issued at a virtually 0 interest rate. It talks to the strength of the US credit worthiness i.e. the perceived ability of the government to pay its debts. As one of my clients put it “This is a nose dive, but we will pull out and gain altitude.” I believe this to be true and history has proven this to be true time and time again. Pandemics don’t last forever. Most of the global commodities are traded in the US dollars. US dollars have been a cornerstone for the global currency market as well and as long as that remains true, our economy will be relatively more stable than other countries.

We are overweight in US large companies specifically within technology and consumer staples, again these companies typically have the cash reserves on hand to weather the economic uncertainty. And on the fixed income side we have longer term US government bonds for credit quality and for further rate decreases (bond prices should go up). Being US focused in the down turn thus far has caused us to reduce large amounts of risk and protected against the downside better than comparable portfolios.

However even with all the good news written above the US economy faces many headwinds and like last week’s article where we talk about the economic gravity we can’t avoid. We still have a long way to go to be back on track with growth and inflation. We still continue to be defensive with our tactical portion of your portfolio because our models show a sizable drop for real GDP coupled with low inflation. Typically, in this environment of slowing growth and slowing inflation we want to hedge on cautious side. Its hard to be defensive in the face of all this good news but the process has worked and there is no need to further adjust our strategic weights at this time.

Texas is open for Business

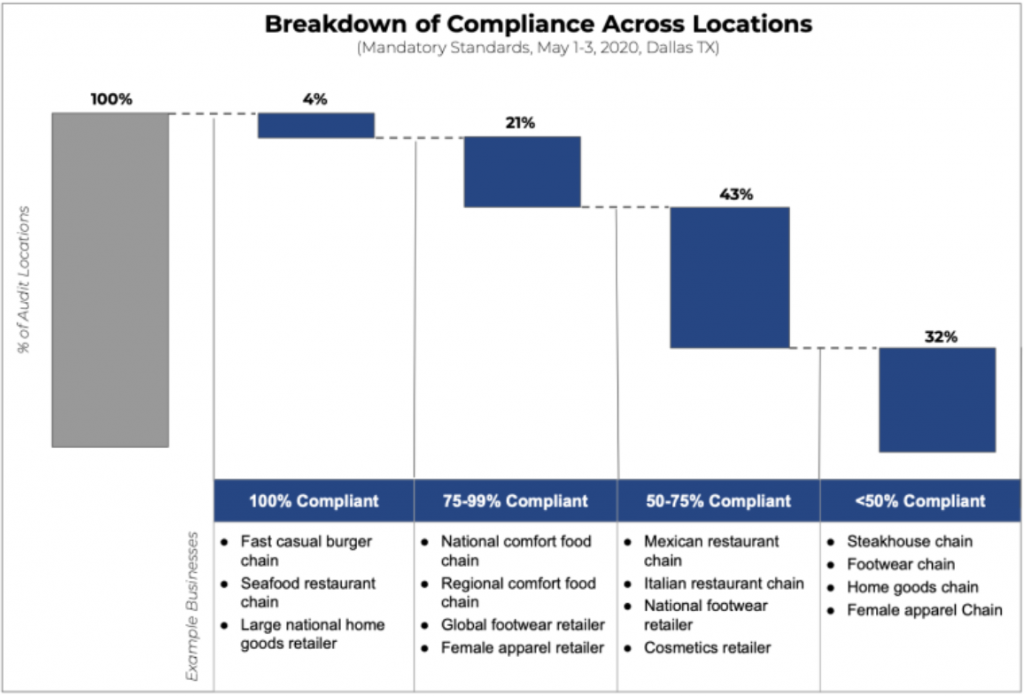

Texas is open for business. It seems that when Dallas was hitting new highs of daily Covid19 cases and deaths that the state may pause their reopening. But they didn’t and Mark Cuban wanted to see how business were opening and adherence to Texas state laws (Mark Cuban's Secret Shopper Study). For the first week of May he hired a company that sent secret shoppers into stores to gather data. They used a combination of yelp reviews and population density maps to choose a 1,000+ locations to visit. Here are some key take aways:

- Only 36% of restaurants re-opened in the first week of May.

- Over 95% of business were not 100% compliant with state rules

- Little to no enforcement of the mandatory rules.

Now granted this survey was less than a week long and at the start of an opening. Most people may have been still interpreting what the rules mean. But it goes to show that there isn’t a clear picture of what needs to be done by business to keep consumers safe. In fact, I went for a bike ride and saw our local smoothie shop was open for business. Everything felt good until I asked for a straw and the lady pointed to a large box of unwrapped straws that everyone would reach in and grab one. Probably not ideal. What I am trying to illustrate is that States are opening up, and people are itching to go out. But individuals need to be responsible; Business owners are not 100% knowledgeable on what they can and cannot do to keep employees and customers safe. And there is confusion between Federal, State and local health mandates. We saw this publicly play out this week with Elon Musk and Alameda county. With a high probability of the resurgence of COVID19 this fall it remains imperative that Federal, State and local government work together to issue clear guidance to businesses around the ability to remain open.

Taxes

A couple weeks back we talked about size of the US Debt. Today we are talking about our ability to service the debt we have taken on. In fact, in the last 3 months we have taken on a level of debt that totals 150% of all the Federal taxes collected in 2018. Meaning that the probability that income tax rates will go up are increasing. Maybe not today but eventually we should plan for higher tax rates across the board. For most of us, income taxes and property taxes are our biggest expense annually. This year with waving RMD’s and different tax benefits through the CARES Act and potentially HEROS Act we will be focusing the 3rd quarter on tax planning. Even though RMD’s are waved, if it doesn’t lower your income to a lower tax bracket or reduce Medicare cost then we may still want to look at doing Roth conversion or rebalance positions with large capital gains as rates maybe higher in future years. We will be working with everyone to get their 2019 tax return uploaded and having conversations around ways to save on taxes today or in the future.

If you are working with an advisor that doesn’t connect together your investments with your current tax situation or hasn’t walked thought tax benefits of the bills Congress has or is passing. We would like an opportunity to earn your business. Please connect with us directly to see if you could be saving money.