The Second Wave of Unemployment

Key takeaways:

- Second wave of unemployment is on its way

- Retail investors largest segment of buyers

- Having a plan to get care when you need it most

Businesses are opening, all states are opening up but employees are having a hard time going back to work. Going into this weekend we will have 40 million unemployed, most of those people have been in the hospitality and service-based industries. From the data it seems that most of these individuals were lower wage earners and we believe this could cause a second wave of higher wage earners towards the end of Q2 (Source - bls.gov). These individuals represent 26% of the entire workforce. With fears of COVID19, warmer weather and an extra $600 a month some people have been reluctant to rush back to their previous job. More specifically, businesses who have received PPP loans are finding it hard to get their employees to come back. This is putting some business owners in a tight bind in order to get forgiveness for their PPP loan and maintain stable business operations. Furthermore, we feel the probability of more unemployment is increasing as most of these businesses will let go of workers after their commitment to the PPP program ends.

The second wave of unemployment will most likely have a higher percentage of white-collar workers.

Our belief is that CFOs of companies face a series of decision points in this type of environment:

Step 1: to stop buybacks and shareholder distributions (44/500 of the S&P 500 have reduced dividends or buy back plans) - DONE

Step 2: to stop hiring, future growth plans and look for intercompany efficiencies (new product rollout/ RD for most companies have been put on hold) - DONE

Step 3: will be to look at each department and assign business value vs cost that will trickle down to individual employees.

In this environment of work from home, the value of inter office relationships will become less and productivity becomes a larger portion of an employee’s value to the organization. And as we are working from home in a digital environment everything can be tracked. Business are or will be able to numerically quantify one’s productivity and contribution to the overall business and will lead to reduction in headcount by numerical metrics.

A side note - for many, the current sentiment is that work from home is amazing. And, we talk about the future view of the office work environment being non geographically confined. However, from my experience without childcare and extra room it will be very difficult to sustain the productivity metrics that are showing currently in big cities. As employees realize that moving away from big cities for more space and support will soon realize that it will also include a reduction to their income and increase competition from individuals from other countries. We will find a middle ground that works, but it will be interesting to see how companies will work to retain culture and keep a team spirit.

Retail investors have jumped in

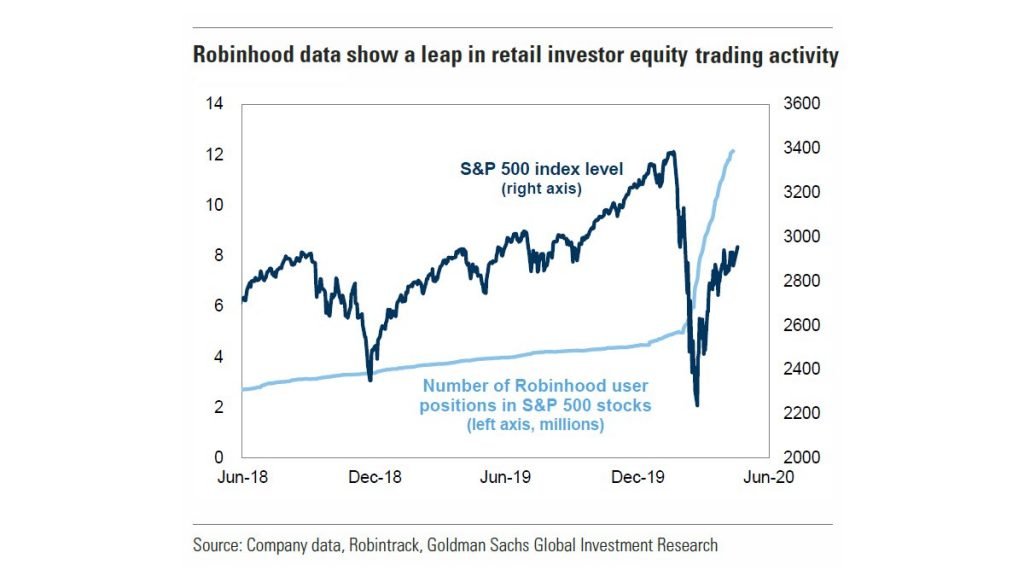

The graph above was in a Goldman Sachs investment presentation that I dialed in for last Tuesday. They had a lot of good data to show the economy is opening back up which is positive given the last ten weeks. The picture above caught my interest – it shows data from a popular investment app used by investors to track retail sentiment. Individuals that are trading via an app on their phones are thought to only focus on the short-term trade without thinking about the big picture. Also, noteworthy that retail investors are the highest percentage of buyers in this environment.

I want to reiterate a statement I said a few weeks ago that the Fed with special purchase vehicle has suspended reality by removing price discovery. The Fed has replaced the credit agencies and now they are fudging what asset prices should really be priced. But this lifeline of liquidity can only do so much and we will see big downgrades coming and default rates rising in high yield market. Some of these companies were failing before the crises. By having a ton a debt already on their balance sheet and buying time will only prolong the negative impact for most of these companies. Look at rental car company Hertz for example, last year they lost $58 million dollars for its 4th consecutive year of loses and was saddled with 19 billion dollars in debt and on Friday filed for bankruptcy.

That is why we have moved high yield exposure to minimal amounts in our portfolios. Debt downgrades will have ripple effects as other corporate bonds will also be downgraded. We continue to stay defensive and as markets have rebounded most have seen values stabilize. No one knows what’s going to happen in the short run within the markets but with the already published economic data we are being defensive protecting the probability of reaching financial planning goals. Here is a slide from the Atlanta Fed policy meeting last week:

That doesn’t look good for GDP and most models we have seen have GDP down from -15% to -60%. BlackRock research has GDP down by 27%. But for most the fear or the attention may move away from COVID-19 and squarely on disastrous economic impact. I am sure we will hear more about this in the coming months but it is important to note the Fed has taken large measures (almost double compared 2008 in 1/3 of the time) and is basically asking congress to print more money. Printing money puts a lot of tail wind in the markets once the money starts flowing but the Fed can’t control business cycles. So being late cycle it is anyone’s guess when money starts flowing. My guess is we are starting Act 2 as discussed in this previous blog post.

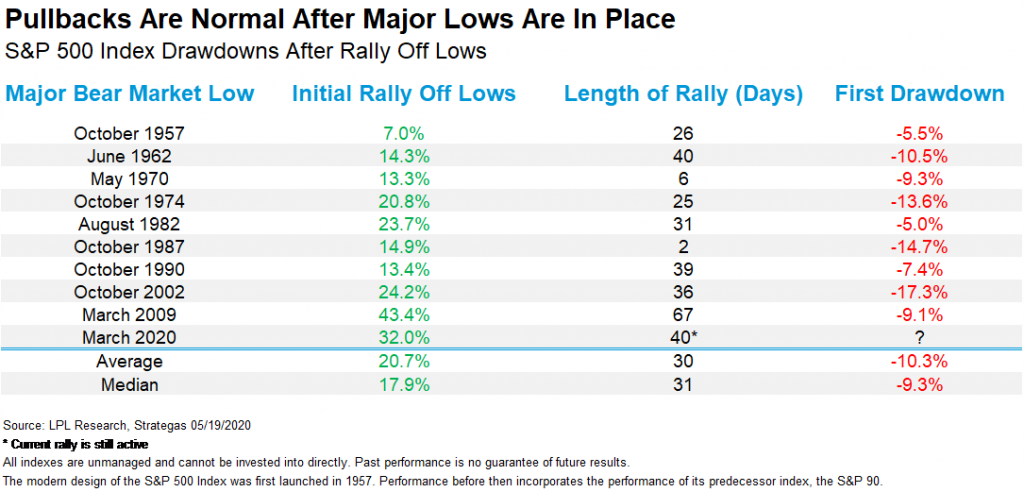

If history repeats, we are well positioned.

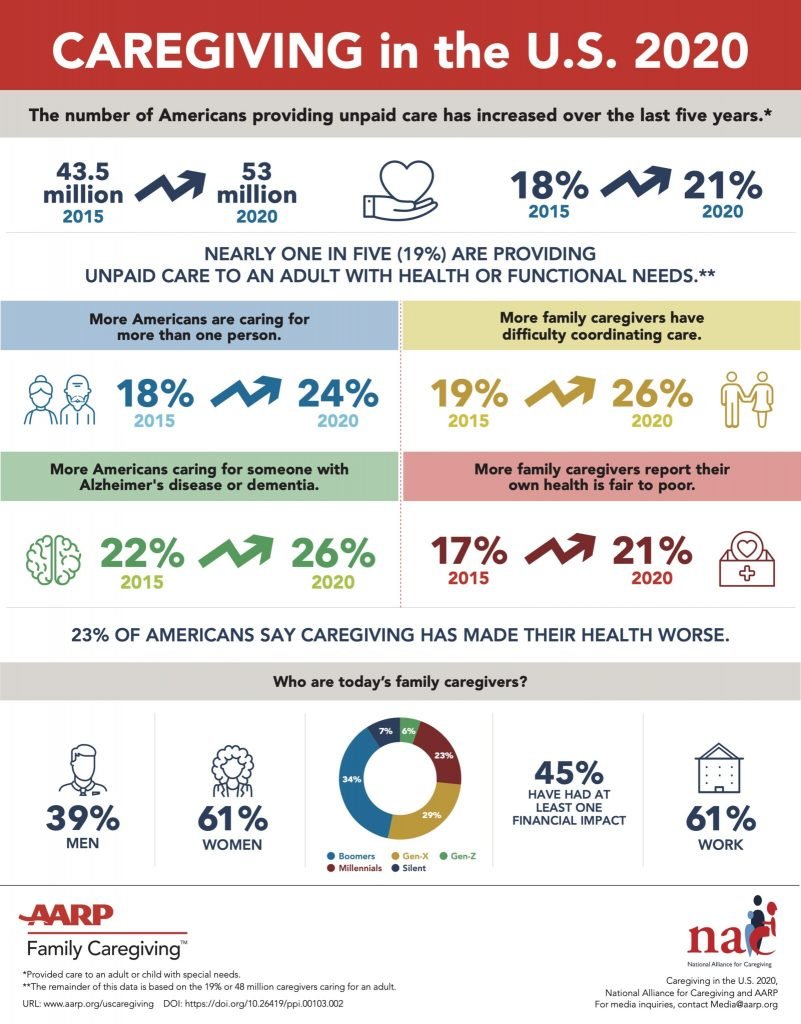

Grandparents are moving back in

COVID19 has also changed family dynamics. It is important to look at the impact this could have on your own situation. As published by AARP a majority of families are considering moving back in together and a majority of care takers are unpaid. Most likely to give care to a parents or parents-in-law (50%), followed by spouses (12%) and grandparents or grandparents-in-law (8%). The average care recipient is 68.9 years old. This is creating a new dynamic within Millennials and Gen X families who currently have kids about to start middle school and are about to enter peak earning years. A rising share of baby boomer seniors do not have family members to help them. They will face uncertainty and difficulty. No one likes to talk about needing care or help. But, as a family advisor, we can help you have this conversation as a family and/or create a plan for you to be independent in the future. Through our portfolio modeling capabilities, we can show you the impact of such cashflow or how we can serve as a successor corporate trustee with both Schwab and Fidelity. Having a plan to create additional streams of income to cover paid help and making sure bills and taxes are in order if this type of situation becomes a reality and gives you and your loved one peace of mind. We have helped create these types of plans which assess life risk, investments, taxes and estate planning.

If you need help modeling care expense towards the end of life or looking at the most tax efficient way to pay for care, we would like an opportunity to earn your business. Please connect with us by emailing us or filling out our contact form.