A 2023 Look at The Fourth Turning

In 1997, Neil Howe and William Strauss introduced the captivating concept of "The Fourth Turning," proposing that history follows cyclical patterns, with each cycle lasting 80 years and divided into four 20-year phases, each linked to a distinct generation and societal role. As society transitions from High to Awakening, Unraveling, and ultimately Crisis, these turning points are akin to the seasons of the year, with Awakening mirroring summer and Crisis likened to winter. The pivotal "Fourth Turning" marks the climax of the cycle, where the hero generation confronts the prophet generation as they enter elderhood.

Unlocking Generosity: Gifting to Family with Strategic Charitable Planning

Expressing love through financial support is a powerful gesture, but understanding the tax implications is crucial. Gifting money to family members goes beyond material presents, offering financial assistance and security. In this article, we'll delve into the nuances of charitable planning and the tax considerations that accompany it.

The Widow's Penalty: Why Tax Planning Matters

As if adjusting to the loss of your spouse isn’t difficult enough, the surviving widow or widower is often left facing an unexpected financial burden. Due to various tax laws, the surviving spouse usually experiences not only a reduction in income, but oftentimes both higher taxes and higher Medicare costs.

4th Quarter Investment Planning Outlook

Before diving into the 4th quarter outlook, let's emphasize the importance of building a robust investment portfolio that guards against various risks. Our strategy actively addresses risks such as equity, interest rates, currency fluctuations, liquidity, credit, inflation, foreign investments, time horizons, and economic downturns.

Mastering High Net Worth Financial Planning: The Unique Challenges of Wealth

In today's ever-evolving financial landscape, the importance of financial planning cannot be overstated. It serves as a cornerstone for safeguarding one's financial well-being against life's uncertainties. However, for individuals and families with substantial wealth and complex financial needs, standard financial planning often falls short. This is where High Net Worth Financial Planning steps in to offer tailored solutions.

Maximizing Tax Benefits Through Charitable Planning - A Retirees Take on Charitable Giving

In the world of finance, philanthropy often takes a back seat to discussions of wealth accumulation and investment strategies. However, as my encounter with corporate responsibility at a Fortune 100 Company taught me, charitable planning should be a fundamental part of our financial journey. In this article, we'll explore the concept of charitable planning, its significance, and how it can be leveraged to maximize tax benefits.

Estate Planning in San Diego: A Financial Security Blueprint

Crafting an Estate Plan is a pivotal move to ensure your financial well-being and protect your loved ones, both presently and in the future. This process provides you with the power to determine how your estate is distributed, shield the welfare of your dependents, minimize the tax burden, and maintain your privacy. However, if you call the vibrant city of San Diego home, there are unique factors that demand extra attention in your estate planning journey.

Ask A Retiree: Adapting Retirement Planning in the Face of Climate Change

Living in Arizona, we often jest about having only two seasons: Heaven and Hell. But the sweltering July of 2023, marked by Phoenix's record-breaking temperatures, underscores a new reality. Across the United States, cities are grappling with unprecedented heatwaves, intense rainfall, and severe storms. Climate change's impact on retirement planning is no longer a distant concern; it's a tangible reality that demands our attention and preparation.

Planning for Retirement: Why Many Are Choosing Not to Downsize

For generations, many Americans have considered downsizing as part of their retirement planning goals. By moving to a smaller home, they could leverage the equity in their existing homes to ensure a comfortable retirement. Yet, as retirement age nears, the decision to downsize isn't as straightforward as it might seem. Many are now choosing to stay put. Here's why:

Setting and Achieving Your Retirement Planning Goals

Are you ready to embark on a journey of fulfillment and joy in your retirement years? Just as you've expertly managed your career with clear goals and purpose, retirement planning allows you to craft a remarkable next chapter. Say goodbye to the pressure of performance targets and embrace a new phase of life where your objectives revolve around personal enrichment, experiences, and well-being. Let's explore how you can set meaningful retirement planning goals that will empower you to relish every moment.

Mid-year Investment Outlook: Navigating 2023 and Beyond

As we step into the latter half of 2023, it's crucial to grasp the evolving dynamics between the economy and the market. In this mid-year investment outlook, we delve into the key occurrences of the past six months and shed light on the potential paths that lie ahead for your investments.

Ask A Retiree - Navigating the Path to a Fulfilling Future

I have heard the terms semi-retired, working in retirement, scaling back and “just doing a little consulting here and there”. Why would anyone want to work in retirement in the first place? Why would I retire if I still want to work? Am I retired if I am still working? I must admit I am not in love with the word retirement. If I were still in the corporate world this is where I would insert a Webster’s or Wikipedia definition of the word “Retirement” into my presentation. I will skip that for now and just assume none of us really know what retirement means, or at least it means different things to different people. I have been spending more time talking to retirees and learning from some of their experiences as well as learning from my own experience.

Optimized Benefits of Grandparents Funding a 529 Plan for Their Grandchildren: Smart Tax Planning for the Future

When it comes to securing a bright future for our children, grandparents can play a significant role. One powerful way they can contribute is by funding a 529 plan, an educational savings account with numerous benefits. In this blog post, we will delve into the advantages of grandparents funding a 529 plan for their grandchildren. We will also explore what happens to excess funds within the plan and the potential opportunities with new rule changes taking into effect in January 2024.

A Retirees Perspective on Retirement Planning: Beyond the Finances

Too often, when people think about retirement they focus too much, if not solely, on the financial side of retirement. I had a 35-year career in Financial Services, I understand the importance of being financially prepared. Equally important is the non-financial side of retirement. The “how am I going to live” and “how will I spend my time” side of retirement.

Navigating The Debt Ceiling Crisis

Global monetary policy hinges on the value of a risk-free asset plus a premium, and for years, US Treasuries have played this role effectively. Treasured for their liquidity and safety, they have served as collateral in countless global trade transactions.

Navigating Q2 2023: Investment Planning in a Shifting Economic Landscape

Key takeaways:

1. Reiterating: Profit-based recession is likely with major credit events

2. Reiterating: Risk of recession > risk of inflation

3. Reiterating: Fed pivot unlikely

It’s been an eventful start to this year. We have already had the 2nd and 3rd largest bank collapses of all time. The CPI calculation has changed for the first time in years. Mortgage rates hit 7.1% for the first time since 1993, and we are only three months into 2023. It’s only April and 2023 is already a year that will be remembered.

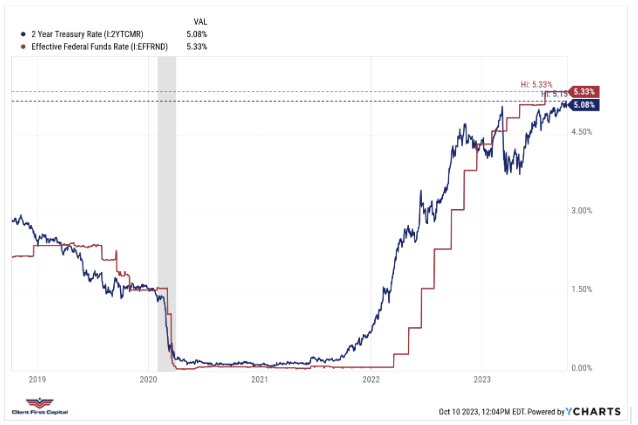

Top 3 Retirement Planning Lessons from Silicon Valley Bank

Well, it’s hard to hide from the news of the Fed and Treasury coming to the rescue of depositors of a failing bank. Silicon Valley Bank is the 20th largest bank in the United States of America and mainly serves the needs of startups and venture capital firms. And because of mismanaged risk and the inability to create liquidity when needed, the bank was taken over by regulators from the FDIC last Friday. This article covers the events that led to the failure of the bank and broader impacts as well as lessons learned from these series of events that can be applied to managing retirement.

Understanding SECURE Act 2.0 for Tax and Retirement Planning

The SECURE Act 2.0, a recent legislative update, ushers in substantial alterations to the landscape of retirement planning. This new law is aimed at bolstering retirement security for Americans and addressing the challenges inherent in the current retirement system. In this article, we'll delve into the key changes brought about by the SECURE Act 2.0 and their potential impact on retirement planning and tax planning strategies.

The 2023 Investment Outlook and Investment Planning

Happy New Year! As we embark on our journey into 2023, we would like to share a comprehensive investment outlook that revolves around effective investment planning. The year 2023 brings with it a changing economic landscape, where legislative changes and global events influence the current market conditions.