Investment Themes

Key takeaways from this newsletter:

- Pensions are borrowing money to prop up returns

- Slowing growth and the potential for inflation

- Congress will need to work on another round of stimulus

- Building secure family futures

Investment Outlook

No manager or individual investor has a crystal ball around future market performance. That said, our data is still showing that the US economy is transitioning from a correction to a recession, not a recovery. This is kind of like turning on all the lights on your way to the kitchen in the early morning hours only to realize once you get to the last light switch the floor is wet and the kitchen sink is overflowing. We have seen rebounding numbers due to reopening, but once we get to the last few states to fully reopen, we will realize something is wrong; or we may already be there with states changing their phased reopening. In this newsletter, we cover pension accounting, struggling businesses and consumers needing more help.

Pension Accounting

Pensions are borrowing money to prop up returns.

We continue to have a lot of headwind and corporate debt is a larger problem now than pre COVID-19. A majority of businesses chose to raise their debt levels because of corporate buy backs and record low interest rates. Further, the Fed has just extended credit to these same companies causing the debt burden for these businesses to only increase. We are also seeing this increased debt burden within private equity owned companies like Hertz. Recently, Blackstone Hotel Group, a major hotel owner and real estate developer skipped payments on their $274 million dollar loan, and they are not the only ones. We are seeing similar leveraging of debt within pension plan securities.

Take for example CalPERS which is one of the largest pensions plans in the US. At the beginning of this year CalPERS had close to $400 Billion dollars. During the recent market volatility CalPERS has dropped to 60% funded. A tax increase of $2,884 per household would be needed to get the CalPERS pension funding back to 70%. This example illustrates that all investors (institutional and individual) have to deal with and have a plan around market volatility. Investment losses in pension plans require more deposits to offset those losses or a cut in benefits. This is very difficult as most pensions plans are very difficult to modify. And, in the case of CalPERS which is the pension plan for state and local government employees in California, most local governments are losing tax revenue making it difficult to increase deposits. As a general rule, most pension plans aim for at least a 70% funded rate (well-funded plans are 90% or above). Since CalPERS requires a 7% rate of return on its investments in order to stay on track for adequate funding status, the plan is subject to the volatility of the markets. And, this recent market volatility has caused a number of large swings causing the plan to go from being adequately funded to being underfunded.

To meet its funding needs, CalPERS plans to borrow $80 Billion in the form of pension obligation bonds. This borrowed money will be used to increase the plan’s asset base which results in artificially reducing the high hurdle rate. “Leverage allows CalPERS to take advantage of low-interest rates by borrowing and using those funds to acquire assets with potentially higher returns”- WSJ. This is risky, and we have seen this before when firms took on debt to reinvest in corporate stock and make a spread between the difference. The problem with trying to make a spread when having ongoing debt servicing is that in down years you will have to withdraw more from the plan to meet both ongoing pension obligations and increased debt service causing the breakeven rate to be even higher in those down years. It will be interesting to see what other pension plans do in the next 3-5 years since many are underfunded and have benefits that are hard to fund.

Struggling Businesses

Congress will need to work on another round of stimulus.

Many small businesses are continuing to struggle in this environment. The business from the chart above from this article (Source - WSJ) also states that 75% of small business cannot last longer than 4 months should we head into another shutdown. It is currently estimated that by the end of this year, 26% of all companies will be “Zombie companies” – i.e. have just enough in earnings to pay debt. It is a difficult road ahead for companies given multiple uncertainties. Many companies are pivoting business models in an effort to remain viable in a Covid-19 environment. Some are opting to create a more robust digital experience. But these changes require capital and time and pivoting business models will prove to be difficult to execute for many companies.

Looking into the third quarter, we see the wave of fiscal support ending. Below, I have outlined the stimulus related programs that will end through year end:

- June 30th - end of credit card and auto loan forbearance

- July 1st: start of state and local budget cuts

- July 15th: delayed federal income tax check payments are due.

- July 31st: enhanced unemployment benefits roll off

- September 30th: student loan forbearance programs end

- October 31st: mortgage forbearance programs start to roll off

- December 31st: the PPP grace period ends

With all these fiscal support programs ending, the Fed and Congress will need to act again to avoid another threat of recession. Therefore, it is almost certain that we will be printing more money and another stimulus will be on its way. This is the heart of why we are still defensive with our models.

With growth decelerating and inflation picking up, the odds of another significant pullback are still high.

Better Financial Outcomes for Families

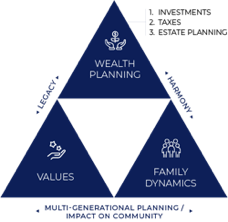

Client First Capital is dedicated to helping build secure family futures.

The number of COVID-19 cases continues to grow and as outlined above, fiscal and credit support programs are slated to end. While more individuals are being affected by COVID-19 now than in April, the number of individuals traveling is only increasing with travel at 6x what it was on the peak of the lock down. (Source -TSA) Another economic stimulus will not slow down the spread of Covid-19. That said, the average citizen will continue to need financial support to remain afloat. Keep in mind 50% of households have less than $1,500 in their bank account. Future shutdowns will continue to create tight financial circumstances for families especially those that are losing unemployment benefits.

Consumption growth looks to have a long road ahead to recovery.

When pre-retirees look further out, they have realized that their own retirements / financial independence could be in jeopardy. Most Boomers who have compensation tied to business results have found themselves in a very difficult position for their own retirement goals. In fact, 1 out of 4 Americans 50 and older have decided to postpone retirement by 3 years or more due to the uncertainty of their income. For many that are in retirement, investment losses or low interest rates in bond securities have meant that investment income has not kept pace with financials needs. The situation is very difficult.

Everyone will be impacted by COVID-19 and everyone will be making decisions around money and finances. We want to help. While the impact to many reading this article may not be directly sizeable due to the amount of wealth saved relative to expenses, there may be other family members that could turn to you for support. Our mission is to work alongside our clients and their families to build and maintain a secure financial future by providing an integrated wealth management solution aligned with values and family dynamics.

By taking a holistic approach which includes investments, taxes and estate planning, we create better outcomes for families.

Feel free to connect with us by emailing us or filling out our contact form. If you would like to subscribe to the newsletter for weekly updates from the team at Client First Capital.