Emotions and Investing

Key takeaways:

- Fed buying individual company junk bonds

- Emotions and Investing decisions

- Coronavirus could permanently cut near-retirees’ Social Security benefits

- New Service Announcement: Insurance Solutions

My camping trip changed from a getting a basic tent to renting an RV for our weekend getaway in the local mountains. After a few days you start to find peace in nature – no cell phones for the adults and playing in rivers with dirt and rocks for the children. I think we have caught the RV bug and we are hoping to take another trip in the next couple of months. Just like my progression from basic camping to the complexities of using an RV, the Fed has also been moving from risk free bonds to buying junk corporate bonds via special purchase vehicles. This is beyond normal operations and is into the shoring up of the overnight repo market, commercial paper, bank’s short-term lending and now public companies. All of these functions are not typical when in a healthy economy. At first, when buying corporate bonds, the Fed used bond ETFs to be non-biased. Now, the Fed is purchasing individual bonds directly. Keep in mind, this is taxpayer dollars buying bonds of companies with the highest risk of default. Obviously, the Fed should not be holding these types of assets. We have covered the long-term impacts in a previous post but a CliffsNotes version is that by removing the ability to price securities based off their creditworthiness every company is getting a participation trophy. Like my daughter getting a participation trophy; it’s great for kindergarteners, but not so much for investors.

In this week’s post we talk about emotions vs. an investing process, a nuance in the social security benefit calculation, and firm update.

Emotions vs. an Investing Process

This March, when stocks were going down the most, many investors thought about selling out of their investments because of fears that the stock market would drop further. Some wealth management firms sold their client’s equity positions in the first week of March, stating that there were too many uncertainties to feel comfortable. This week, since stocks have rallied, some investors are wondering if they should sell out of stocks because asset prices have risen way too fast without supporting economic data.

The truth is that no one knows what is going to happen with investments and that is why we follow a defined process. The only time we make trades is if we hit certain thresholds within the market that cause us to rebalance or if the economic data changes resulting in an adjustment of our tactical positions. Theoretically, it is really that simple, but it is extremely hard to do on an ongoing basis. This highlights that the fundamental difference between an investor and an investment is emotion; as uncertainty grows so does emotion. According to the Dunbar Investor Study people who manage their own investments of $1 million or more averaged a little over 3% return over the last 10 years (2009-2019), while investments in a diversified portfolio of 50% stocks and 50% bonds returned 6.8% over the same time. That’s over a 40% difference over the same time frame. It makes sense to me, since people who sold out in 2008 didn’t start getting back into the market until the end of 2010. It will be interesting to see what the 2021 study shows, because in periods of volatility having a well-defined investment process is the only way to stay disciplined.

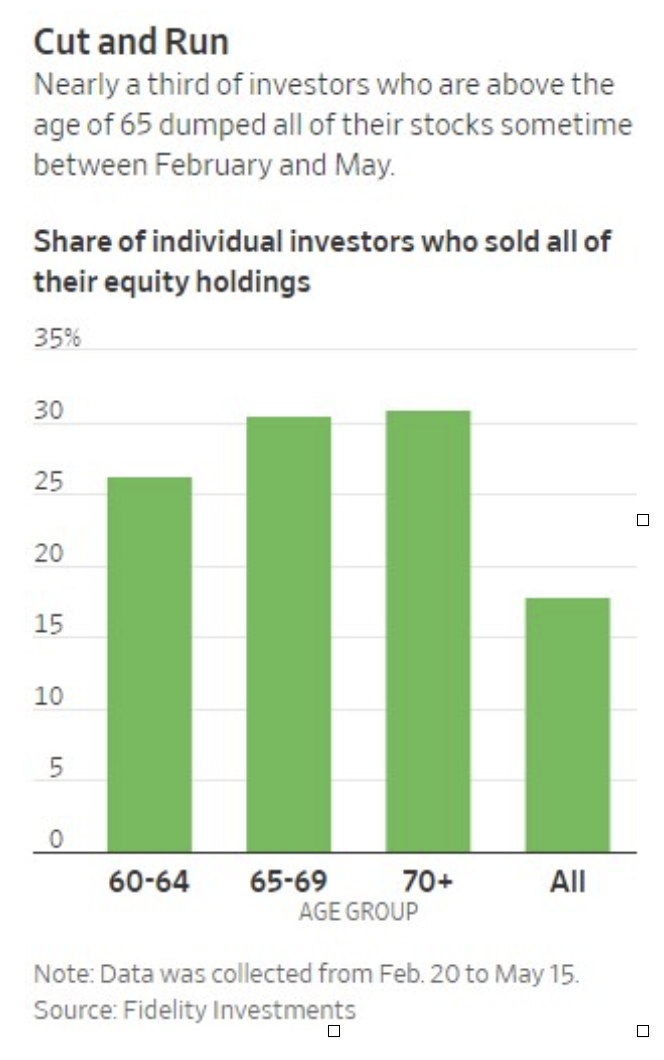

In the chart above you can see about 1/3 of all investors age 65 and above have removed their equity positions. This is 100% because of emotions. Again, as uncertainty grows so do our emotions when making decisions. And with the benefit of hindsight, it is clear to see that we have gone from oversold to overbought when put/call ratios have inverted. One of my goals in these blog posts is to over- communicate our process and reinforce our evidenced backed process to deter any emotion-based decision making. Some of the topics are repetitive, but with COVID19 most of us are watching the news and are viewing our accounts on a daily basis. This is when you need conviction in our process and investment discipline the most.

Social Security and a Nuance Calculation

Congress will need to act in the next 5-10 years to shore up Social Security. As it stands today, 90% of individuals over 65 depend on Social security to pay for at least 33% of expense (Source - www.ssa.gov). If Congress doesn’t act, the average social security benefit could be cut by 21%. Social Security is a large piece of the puzzle for most retirement plans and any cut would have large impacts on retirees. But, a specific group of individuals, those born in 1960 have a bigger risk that their social security benefit will be reduced because the formula used to calculate benefits is based on the top 35 years of earning wages adjusted for the average age factor when an individual turns age 60. Therefore, the 2020 job losses and wage declines will have a significant impact on that calculation, since it lines up with when individuals born in 1960 turn 60. A study from Wharton shows approximately a potential 13% drop in Social Security benefits for this group. (Source - upon.edu).

There are also other impacts for individuals receiving Social Security disability benefits. The calculation for Social Security disability benefits is not as heavily reliant on earning wages adjustment but does factor in COLA adjustments. COLA adjustments which would be close to zero with the decrease in oil prices which make up a significant part of the COLA calculation and could erode purchasing power for these individuals.

If you are born after 1960, we would suggest reducing your social security amounts by 10% and removing any inflation adjustments in your financial plan. These adjustments are intended to give you a more realistic view of potential impacts on the withdrawal rate for your portfolio, reduce the risk of underfunding a long-term care event if you are self-insuring, and potential impacts on legacy amounts. If this is a concern for you, let’s schedule a time to speak about your financial plan to show how any changes in Social Security may impact you or your family’s legacy.

Upcoming Changes at Client First Capital

With the Covid-19 virus, many of the firm enhancements that we were anticipating implementing in the first half of the year were put on hold. However, we are pleased to report that in the third and fourth quarters you will see a few changes that clients have asked us for, and we believe this new functionality will further enhance our relationship. We are a small boutique firm and have leveraged technology to have highly personal relationships with our clients. The changes outlined below are done with the spirit of us being able to better serve you. I am excited to share our roadmap for improvements:

- Quarterly invoices will now also include asset allocation, billing, accounting and performance for overall accounts. This should provide clients an easy way to review their overall accounts and increase transparency. Adding this additional detail to our quarterly invoices means our billing will change to the third business day after the end of the quarter instead of the first Friday.

- We will be rolling out compliant text messaging and security verification. This means that if your preferred method of communication is text messaging or if you have a quick question, we will be able to communicate via text. In addition, if we are doing money movement we can confirm your transfers and send confirmations via text. Text messaging will not replace our conversations, but will help make short conversations and confirmations easier.

- We will be starting an online calendar scheduling system. It will provide clients easy access to our availability and allows us time to focus on investments and planning research.

- This September, we will start uploading video content to our website. These videos will focus on integrated wealth planning and cover topics we frequently get questions on given our thought leadership in the space. Longer term, we are also considering creating a video mini-series for adult children to increase financial intelligence around financial decisions. We will continue our biweekly newsletter, but also be referencing videos we have created to illustrate specific points around tax, estate and charitable planning.

- Lastly, in June, 2019 the SEC adopted the Form CRS and new rules. Essentially the CRS is a summary of all the important information about a firm to help customers understand and decide whether to engage with a firm or not. I have attached a link to our form here. There is one change we are making to broaden the scope of our comprehensive services. We will offer insurance products starting in the third quarter to better serve our clients’ needs. As a part of our firm’s comprehensive risk management offering, we evaluate different risks to your portfolio, including withdrawal rate due to a health or life event. Based on this analysis, we may recommend the use of insurance products like Medicare gap, health insurance, long-term care insurance, and life insurance, among others when it is deemed suitable. As a fiduciary we felt that not having an insurance solution to these life events would violate our ability to work in a fiduciary capacity under the CFP® designation. Initially, we are looking to rollout solutions available by Insurance providers like John Hancock, Nationwide, United Healthcare and Anthem Blue Cross.

As most of you are starting your summer plans, please keep in mind taxes are due July 15th. We are here to help; if you need anything, please let us know. If you are working with an advisor that has not reviewed your beneficiary designation on IRAs and Roth IRAs, due to tax changes, let us do a complementary review for you. Feel free to connect with us by emailing us or filling out our contact form. If you would like to subscribe to the newsletter for weekly updates from the team at Client First Capital.