Current Market Dynamics

This week's key takeaways:

- The current market dynamics shows several similarities to the tech bubble of 2000

- Our strategy is to remain defensive

- It's time to start thinking about end-of-year tax planning and charitable contributions

This week marked a milestone for my family, as both of my daughters started in-person pre-school (the first time for my younger daughter). We are fortunate that our daughters are able to attend a school where social distancing and COVID measures can be executed safely. And, both my wife and I are extremely excited to be able to work for a block of time in complete peace and silence for a couple hours a day. However, the night before school started, we got an alert from the school saying class will be delayed for a day due to poor air quality from the fires in San Diego (the school is mostly outdoors). So, we had to quickly switch gears. This time of year is the start of the fire season for San Diego County, but typically winds go west to east. Currently the winds are going east to west and that is causing record temperatures and headaches for schools which are increasing outdoor time.

I am sharing this story as this newsletter was originally planned to be a continuation of the previous newsletter which focused on Medicare. Yet, with the recent market volatility I felt it to be prudent to switch gears for this newsletter to focus on current market dynamics and how we are positioned relative to the environment. Like the weather map above, we need to be ready for fire, freeze and snow with our current investments. I still plan on continuing the Medicare series newsletter in our next installment which will focus on Medicare part D, comparing Medigap/Medicare Supplement plans to Medicare Advantage plans and how TRICARE fits into Medicare. This is important information since most seniors will reevaluate their coverage starting October 1st. But, for now, we are switching gears.

Market Environment

Let me first share some perspective on the current economic environment. Interest rates have never been this low for so long in history. The global printing currently in effect has only added to the disconnect between Main Street and Wall Street.

Here are some statistics to think about:

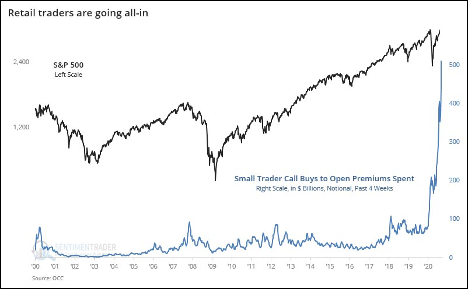

As of March 23rd, the S&P 500 was down -30.4% for the year. Yet, as of the end of Wednesday (September 10th) the S&P 500 was up 6.8% YTD. The largest sector comprising the S&P, technology, has driven the overall rise. As the technology sector is causing a run up in the market, there are several similarities to the tech bubble of 2000. One such similarity is the rise of the volume of small share purchases.

Retail traders have jumped into the investment management business. I remember in 2001 and 2002, when people would be day trading internet stock at lunch to get rich. The volume of day traders has significantly increased since the lockdown. Individuals working at home or stuck at home and the ability to trade at no cost has helped fuel a desire to make money. Many Millennials who have been burned by two economic restarts, housing collapse and slow job growth have tried to steer their own destiny via stock trading. One can watch a couple YouTube videos and think you can go to bat against the big banks like JP Morgan that employ traders that have trading platforms which manage significant trading volume and billions of dollars. Another reason Millennials are getting into trading is that it has been branded as being cool. Applications on phones such as Robinhood, have made the process very easy to scale risk through the purchase of fractional shares and fail to show the big picture.

But COVID is still here. No one knows what will happen, but with volatility rising there seems to be an inflection point happening. Either the bubble continues to grow i.e. markets will continue upward since the risk-free rate is 0% and that will justify higher valuations in asset prices. Or the party ends with the realization that millions of jobs are not coming back which is being echoed by a number or leading market analysts. Again no one knows.

Christian Drake, a market analyst with the firm HedgeEye has some insightful commentary on unemployment which I wanted to share:

“With Initial Claims rising, Continuing Claims rising, Total Claimants increasing for a 2nd week and higher-frequency labor indicators stalling/deteriorating on the margin in recent weeks, evidence of a rotation from direct & ‘temporary’ pandemic related job loss to permanent/structural job loss alongside protracted demand suppression and the expiry in jobless benefits and payroll support measures is beginning to cumulate.

Recall, some measure of scarring/hysteresis was always inevitable – the scale and scope of which was directly tethered to the duration of impact as the capacity for first order effects to network out and propagate 2nd round layoffs and emergent job loss in adjacent industries while metastasizing up the white collar/income hierarchy remained, primarily, a function of time.

With the labor shock in its 25th week and now spanning its 7th month, the clock tick of urgency has morphed to maddening beat for businesses operating on the edge.”

Our Strategy – Remaining Defensive

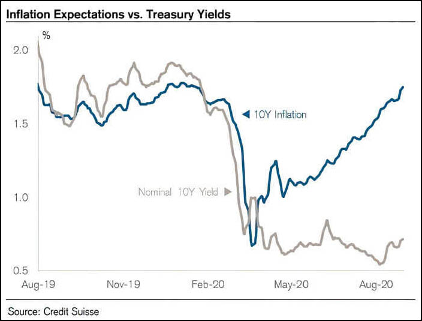

This entire year (even pre-Covid) we have remained defensive in our positioning given an overall slowing in economic growth. In late July we trimmed our large cap equity holdings as we bought into diversified mid-size companies, technology and utilities. On the fixed income side, we reduced credit risk by adding government backed bonds and inflation protected securities. Our overall risk management view is still that the Fed is going to drive inflation up with monetary policy and growth remains questionable with COVID hotspots still growing. In the chart above you can see the relationship between inflation and interest rates is broken. The Fed will need to take more aggressive measures than printing money and creating Special Purchase Vehicles to prop up the markets.

In fixed income, one of the biggest headwinds we face is that high quality bonds and government bonds have almost no yield. While the overall market flow of dollars is into high risk bonds, we remain conservative since no one knows how long the Fed printing press will last. That said, staying defensive means lower current yields. For retirees this can be concerning especially to those drawing consistent income out of a portfolio. To reiterate, we believe it to be too risky to invest in companies highly leveraged in debt. Especially, as these companies continue to take on more debt by the government, the probability of default increases. Yields only tell one half of the story and this year the safety of principal may be worth more than chasing yield.

Volatility will continue to be high as we head into the election. We have right sized risk for portfolios at the end of July and continue to monitor our ranges to make sure we are ready for different outcomes (fire, freeze and snow).

If you would like to review the risk in your portfolio within current market dynamics, please reach out to our financial advisors for a complimentary review at info@clientifirstcap.com