Path Forward from COVID-19

I have been fixated on this dashboard by John Hopkins (https://coronavirus.jhu.edu/us-map) It shows in real time data related to COVID-19. You can also drill down to your city and get some interesting statistics. The picture above is for San Diego. To give you an idea of scale, if the drastic changes, like social distancing are not adhered to, the COVID-19 numbers nationally will be on track in the next month to have the same number of deaths as US soldiers in Vietnam. This will be the largest pandemic we have faced and there will be a lot of lessons learned. For example, should we have 70% of US pharma manufacturing outside of the US borders? I bet someone from the DOD would consider this a national security risk.

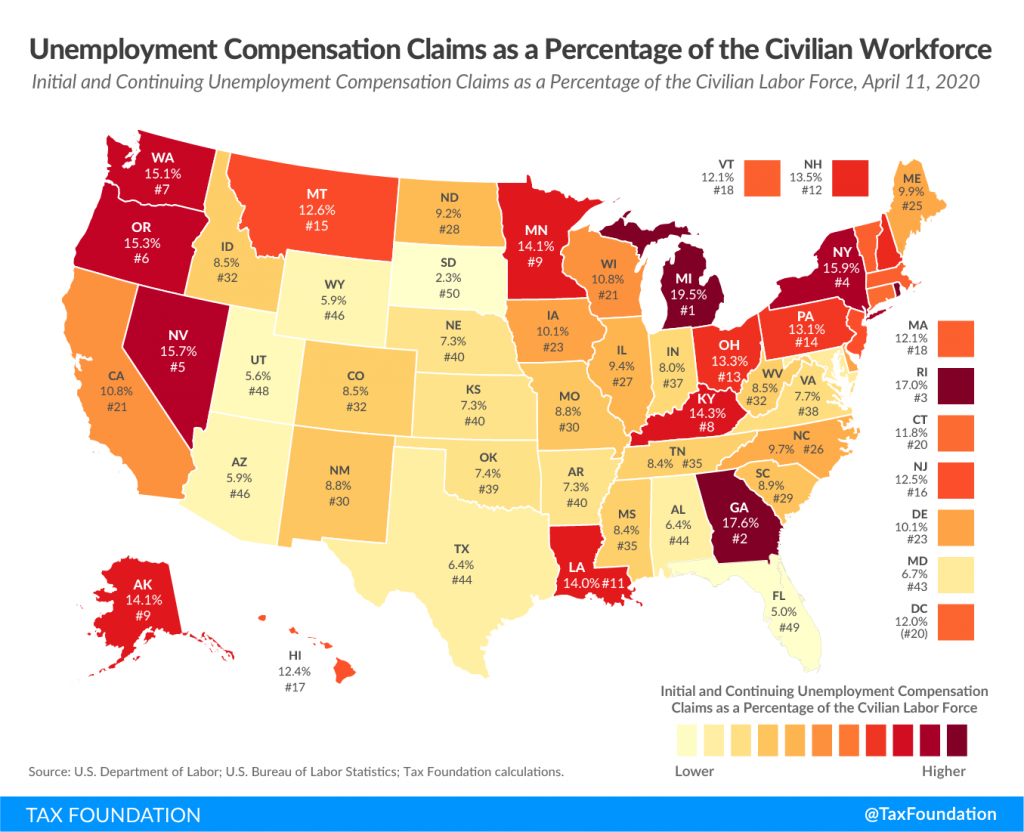

Wall Street is rallying because they believe the Fed’s spending ability to backstop the economy is stronger than COVID-19. My disconnect with that is the Fed can only do so much and it is the private sector that needs to begin to function at some point. We believe the full economic fallout from COVID-19 is still not felt. The rise in unemployment is a leading indicator for the financial impact of COVID-19 on market performance. And as the unemployment numbers keep growing the harder it will be to have a U or V shape recovery. Again, there are three parts to this problem; liquidity, credit and COVID-19. Through monetary and fiscal policy, the government is hard at work for liquidity and credit. But COVID-19 looks to disturb business well into the end of the year which will keep employment numbers uncertain. Almost all recoveries start with high unemployment but the longer this environment persist the more likely we are going through lasting change. Work from home may actually be part of diversifying the workforce load and may cause commercial office buildings some real headwind ahead.

Small Businesses need access to liquidity…but…beware of debt burden

The Small Business Association’s two plans to help small business owners has run out of funding. That’s right, the Economic Injury and Disaster Loan and Paycheck Protection Plan have allocated all funds in less than 2 weeks. At this rate I would call this an economic rescue more than a stimulus plan and therefore Congress will need to come back and create part 2 of this plan. But at the end of the day all these businesses are taking on records amount of debt. The same companies that have very little cashflow. This makes it hard for companies to generate profits. I.e these companies will become zombies to debt serving. Current estimates are that 12-16% of all companies will become zombie companies to give some perspective in 1990 this number hit a low of 2%. Debt burden government and debt burden corporations will have a big impact for future generations.

Here are some US debt numbers: https://www.usdebtclock.org/

The Markets

The IMF thinks the global growth will shrink by 3% in 2020, which will be one of the largest global contractions we have seen in more than a couple of decades. With data coming in for Q1 we are already seeing mix results and earnings that have missed revised estimates. More data coming between now and the end of the month. Although we are focused on cashflow we are more concern with balance sheets to see which industries have enough cash to weather the storm. We also believe that Q2 numbers will give us a more realistic idea of where we are heading.

It’s hard to sit in defensive portfolios when seeing this rally (2 weeks) but just keep in mind no one knows the future and we continue to follow our discipline process based on fundamentals which are all still pointing to negative signs.

Risk to Pensions

Pensions have long been underfunded but with the bull markets they haven’t been in the front page of the news since the pension reform act of 2006. That may change. A combination of underfunding and negative cash flow makes for a lethal cocktail. The portfolio managers for pensions can’t afford to take a long-term view and rely on markets to recover and will be forced to sell assets to meet pension obligations. The two bigger concerns for pensions, lower interest rates have caused an overweight into equities and that creates more uncertainty in volatile markets. Not to mention not good for the fund to match liabilities for withdrawals. Secondly, some of these businesses have significant risk and may need to file for bankruptcy. If you have a non-government pension, look to see the funding levels within the pension.

Another Risk on the Horizon

As the government commits to being the backstop for all business and do whatever it takes to stop a decline into a deep prolong recession. We see expenditures by the government increasing and tax revenue to decrease which will further the budget deficit. We are already on track to spend over 12 trillion dollars and a lot of business and individuals have lower income and extra losses to write off this year. This gives me some concern regarding inflation maybe 2-3 years from now. That is why it is important to still own stocks in this rocky environment. In both of our rebalances this year we have added to equities. Also, as we look into the future the printing of money will also potentially increase the wealth gap between people who have stocks and those that do not. People will also continue to work longer and you may find families with their children’s upward mobility or job security on fragile terms. This is a good time revisit how your wealth will impact you, your family and the community during these times. Feel free to contact us at info@clientfirstcap.com if you would like us to take a look at your portfolio.