4th Quarter Investment Planning Outlook

Key Takeaways:

Liquidity Concerns: Rising credit risk among bonds due to drying liquidity.

Inflation Worries: Inflation is reaccelerating, affecting various sectors.

Debt Dilemma: The US debt continues to grow at an unsustainable pace.

Enhancing Your Investment Plan with Risk Management

Before diving into the 4th quarter outlook, let's emphasize the importance of building a robust investment portfolio that guards against various risks. Our strategy actively addresses risks such as equity, interest rates, currency fluctuations, liquidity, credit, inflation, foreign investments, time horizons, and economic downturns.The economic conditions dictate probabilities, and those probabilities dictate outcomes. Diversification is key because absolute certainty is rare in the investment world. The focus should be on limiting the impact of unfavorable investments within your portfolio.

Diversification: Tailoring Portfolios for Stability and Growth

Effective portfolio construction is a crucial element of risk management. Our approach employs the quadrant framework, using data-driven probabilities to create asset allocations that protect clients' assets from inflation while fostering growth over the years.

Recognizing that unforeseen events can disrupt even the best-laid plans (e.g., conflicts like Israel and Hamas), we complement our portfolios with low-risk assets that match clients planning goals and risk tolerance. This synergy ensures our clients' investment goals are met.

Assessing the Current Economic Landscape

Be assured that we are watching recent global events and staying mindful of the potential impact of investment portfolios. We've outlined economic probabilities using a rate-of-change perspective. Our investment framework is rooted in assessing the incremental changes in GDP and inflation. Visit our website to delve deeper into our investment framework.

Although there's no dominant quadrant over the next three quarters, Quadrant Three (stagnation) seems the most likely scenario based on today's data. This suggests an environment with diminishing growth and increasing inflation.

Q4 2023 Quadrant Analysis

Our Investment Process: Focused on Growth, Inflation, and Policy

Our risk management process hinges on growth, inflation, and policy. Monitoring these variables helps us position assets for the best risk-adjusted returns. Let's explore these factors in detail.

Growth Outlook

In the 4th quarter, our outlook remains unchanged: growth is stagnant or slightly declining. Additionally, several factors, including the UAW strike (Estimated economic loss of 18 thousand employees striking is $200M a day), student loan repayment ($300- $800 payments per month), childcare federal funding expiring (3 million children will lose access to childcare), COVID business loan repayments start ($380M in loans will have their first payments) and a health insurance premium spike, pose additional headwinds.

It's also worth noting the risk of another potential government shutdown. Historically, each government shutdown costs taxpayers 0.2% of GDP per week. We are reiterating that larger credit events are likely due to lower liquidity levels, and we are positioned appropriately for this outcome.

Inflation Outlook

With a tight labor market referenced in the last jobs report, the data shows more individuals are now working 2+ jobs or working side jobs (447K with 2+ jobs, 1.2M unincorporated self-employed, i.e., uber drivers, Instacart, etc.). Inflation seems poised for a resurgence due to strong demand. The cost of shelter has continued to rise, though it appears rents are finally leveling off. Food prices gained 0.2% for the second straight month. Grocery food prices rose 0.2%, slowing from June's 0.3%. Cheaper dairy products, fruit, and vegetables partially offset more expensive meat, fish, and eggs. Oil costs have already been increasing, and now, with a potential war in the Middle East, oil could easily re-accelerate.

Policy Outlook

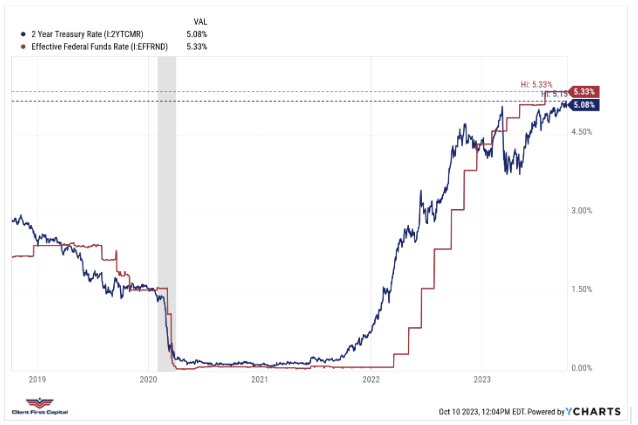

The Fed currently has an effective Fed funds rate of 5.3%, making rates 2% or more higher than inflation. To fight any future acceleration within inflation, it may continue to raise rates. It is important to note that 1/3 of treasuries are coming due over the next 5 years and we are replacing that debt at a cost of 3-4% more in interest. If the Fed continues to raise rates, the number of bonds issued will also need to increase. The US today added roughly $275 billion in debt, and we are on track to pass $34 trillion by Halloween. That’s a relatively scary position to be in overall. Strategically, we have short-duration bonds as a core position with many clients with a majority of bonds held with durations less than 2 years.

Our Strategic Approach

Our strategic view has been correct thus far. A profit recession and commercial bond downgrades are happening at an increasing rate. However, as US economic growth continues, the market has shrugged off most of this negative news this year. In the last 4-6 weeks, the sentiment has shifted and higher rates will be here for longer. Keep in mind that interest rate-sensitive investments have historically been the strongest performers heading into and out of a recession. We also hold gold and US Dollar investments as part of our core allocation. We remain in our core holdings as diversification continues to be important given economic and geopolitical risk.

Planning for Success

If you're curious about how we adapt portfolios to achieve your goals, watch our video or schedule a free portfolio review. We'll outline key risks, economic impacts, and real data comparisons to help you make informed investment decisions.

Stay ahead in the 4th quarter with our investment planning insights. We've covered key risks, inflation concerns, and the growing US debt. Our proactive approach to portfolio construction and risk management ensures your investments are well-prepared for the ever-changing financial landscape.